Monthly Investor Update November 2025

What happened in November, how our funds performed, and our outlook ahead.

November Market Recap

JCI extended its rally and reached a new high, driven by momentum stocks amid the recent MSCI rebalancing which drew renewed foreign interest on new constituents that had been added to the index.

Blue-chips stayed quiet, with limited flows as foreign investors remain cautious about Indonesia’s new political environment.

BI kept rates steady at 4.75%. Click here to find out why.

Simpan’s Fund Performance

All funds outperformed benchmarks in November, except for our Bond Fund.

Money Market: Positive and stable returns, outperformed benchmark.

Equities: Strong gains due to our exposure to select momentum names which saw meaningful flows.

Fixed Income: Down slightly, but still outperformed the benchmark due to our off-benchmark holdings which provided resilience.

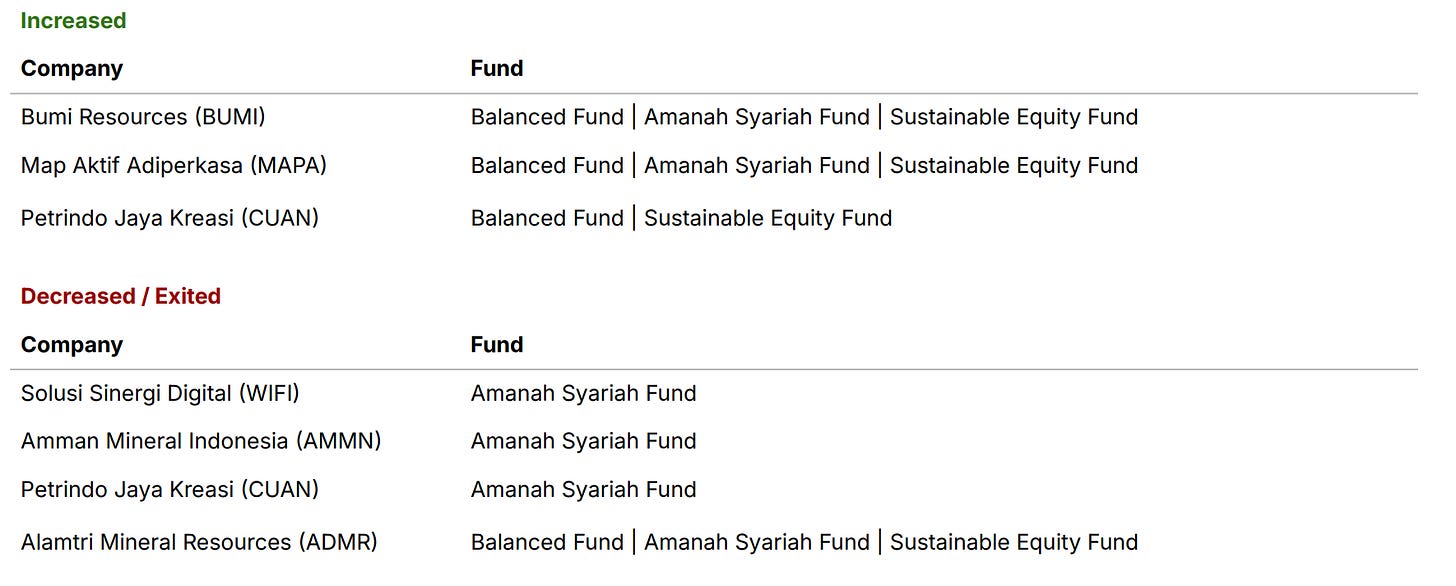

Below is a quick snapshot of our key trades during the month. For the full story behind each move, check out our November Monthly Report.

Or click here for the Indonesian version.

Our Outlook

We expect the Fed and BI to continue their monetary easing in December. Though we expect this to provide a constructive backdrop for global and domestic markets, we also anticipate some profit-taking as investors usually take a more defensive stance and hold a higher cash balance towards year-end.

Here’s how we’re positioning our portfolios:

Fixed Income: Continue to keep our portfolio duration conservative and slightly below the benchmark duration.

Equities: Tactically rotating into momentum stocks to capture opportunities and upside.