BI Kept Rates Steady at 4.75%. Here’s Why.

A quick breakdown behind BI's latest decision to keep rates steady.

Bank Indonesia kept its benchmark rate unchanged at 4.75% last Wednesday, in line with market expectations. BI made it clear that stability was still their main priority, especially with global markets still volatile. Below is a deeper dive of what drove BI’s decision.

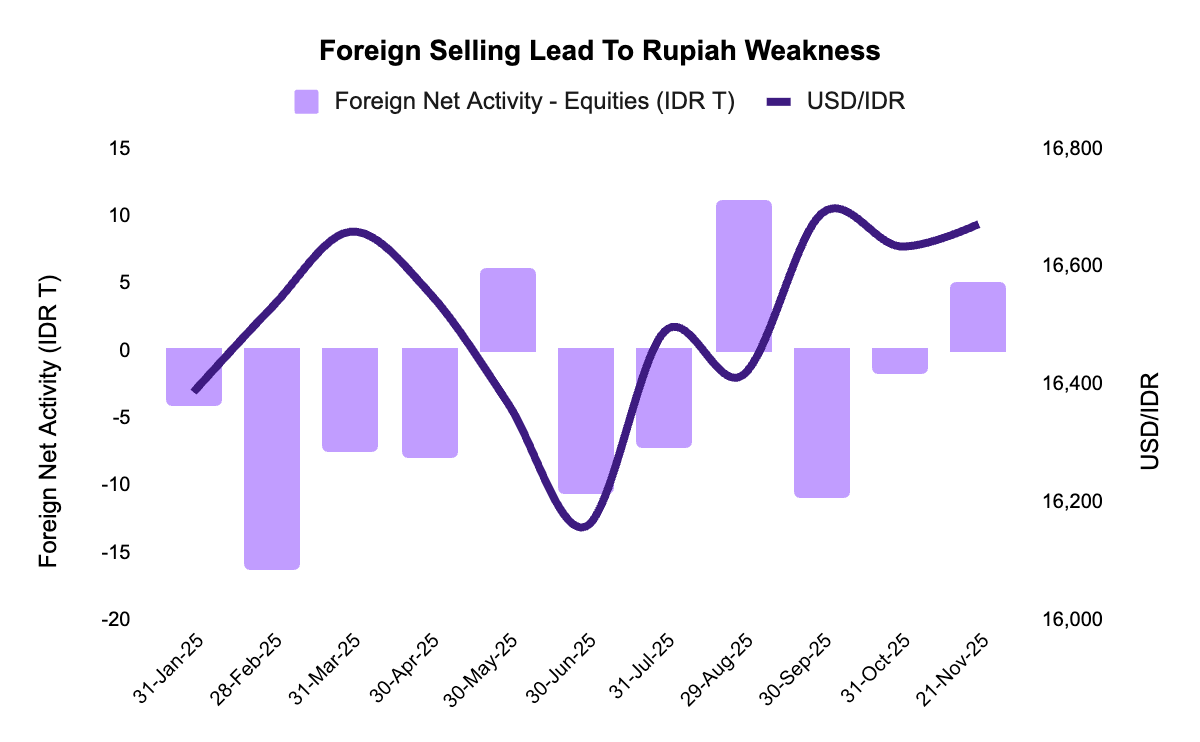

1. Rupiah Seeing Continued Pressure

The Rupiah has weakened nearly 3% against the USD this year. A weaker Rupiah means it becomes more expensive for Indonesia to pay for imports or foreign debt, so BI wants to avoid moves that could make the currency even more volatile.

Below are some of the key forces that have been weighing on the Rupiah this year:

Global Risk-Off Sentiment

Recent trade tensions between the U.S. and China have made global investors more cautious. With both countries central to global supply chains, any disruption tends to hit Asian markets first. When global markets have a cloudy outlook, investors often tend to derisk (pull money out) of emerging markets like Indonesia, which has contributed to foreign outflows and added pressure on the Rupiah.

China’s Slowdown Weighing on Exports

China’s economy has seen a slowdown this year (Q3 GDP grew 4.8% vs Q2’s 5.2%) as trade war and weak demand highlights structural risks. The country’s cooling economy also means softened demand for key Indonesian commodities like coal, nickel and palm oil. Lower commodity prices lead to weaker export revenues which lowers the trade balance – another headwind for the IDR.

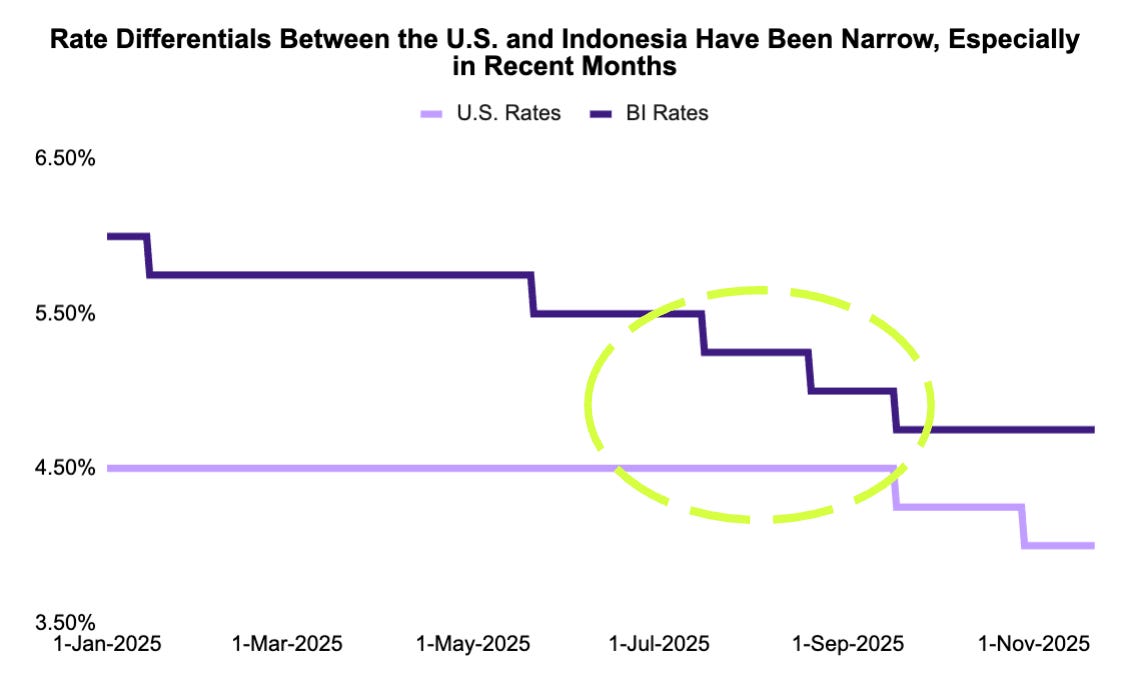

Narrow Rate Differentials Between the U.S. and Indonesia

For most of 2025, the U.S. maintained high interest rates (4.5%), only beginning their easing stance in September. The difference between U.S. and Indonesia’s interest rates have been narrow, which makes Indonesian assets less attractive. When yields are similar, global investors typically prefer investing in USD assets over emerging markets like Indonesia. This led to weak foreign inflows, thus putting pressure on the Rupiah.

Why This Made BI Hold Back on Cutting Rates

With the Rupiah already under pressure, cutting rates now could send a signal that BI is “loosening” policy too early. That could cause investors to pull out more money, which might prompt increased capital outflows and weaken the Rupiah even further.

2. BI Staying Cautious Amid Global Uncertainty

Beyond currency considerations, BI is also navigating a global backdrop that remains highly uncertain. The recent U.S. government shutdown delayed key economic data and further clouded visibility at a time when inflation remains elevated.

Why This Made BI Hold Back on Cutting Rates

With the Fed’s policy direction still unclear, BI chose not to take additional risks. A premature rate cut could have added pressure on the Rupiah if the Fed turns out to stay tighter for longer. Thus, keeping rates steady is the safer option until the global picture improves.

3. Domestic Credit Transmission Still Sluggish

Even with earlier rate cuts, the effect on borrowing costs hasn’t fully passed through. Banks continue to rely on special-rate deposits for key clients, keeping funding costs sticky.

Loan growth: 7.4% YoY in Oct-25

Deposit growth: 11.5% YoY

LDR (Loan-To-Deposit Ratio): Down to 84.4%, showing ample liquidity

Given weak loan demand, cautious risk appetite, and profitability considerations, the banking sector remains conservative. This means even if BI cuts again later this year, the effect on credit expansion may still remain muted.

Why This Made BI Hold Back on Cutting Rates

With monetary transmission still sluggish, BI sees little benefit in rushing into another rate cut. Instead, keeping rates steady allows BI to prioritize currency stability while waiting for clearer signs that lower policy rates will actually translate into stronger lending activity.

Outlook

Governor Perry Warjiyo emphasized that BI still has room to cut rates, but the timing will hinge on upcoming inflation data, growth momentum, and global developments. With growth support taking a back seat for now, BI is likely to wait for clearer signs of Rupiah stability and stronger transmission of earlier policy easing before considering any further cuts.