Monthly Investor Update December 2025

Market events in December, how our funds performed, and our outlook ahead.

Dear clients,

We are pleased to present our December Monthly Investor Update, discussing market highlights during the month, our funds’ performance, and our outlook ahead.

December Market Recap

The Fed cut rates by 25 bps due to rising unemployment, while BI kept rates unchanged at 4.75%. Click here to find out why.

The Jakarta Composite Index (JCI) saw some volatility from profit-taking, but closed out higher by +1.26% MoM. Gains remain concentrated in momentum stocks, while blue-chips stayed quiet.

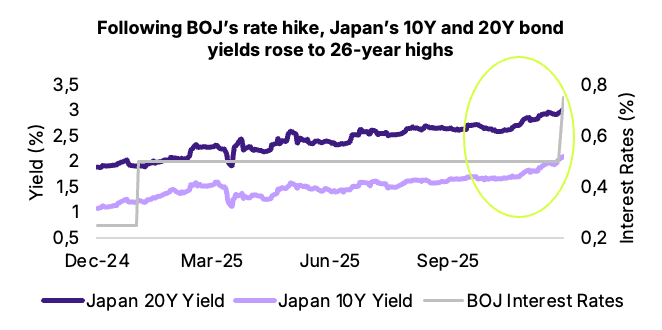

Bank of Japan (BOJ) raised rates to a 30-year high, marking a step towards policy normalization due to rising inflation. The decision triggered a sell-off in bonds, with yields reaching 26-year highs.

Simpan’s Fund Performance

All funds had positive performance in December, with all outperforming benchmarks except for the Bond Fund.

Money Market: Positive and stable returns, outperformed benchmark.

Equities: Strong gains due to our exposure to momentum names and active position management, which allowed us to capture upside while controlling risk.

Fixed Income: Gained slightly, but underperformed benchmark due to our conservative duration positioning.

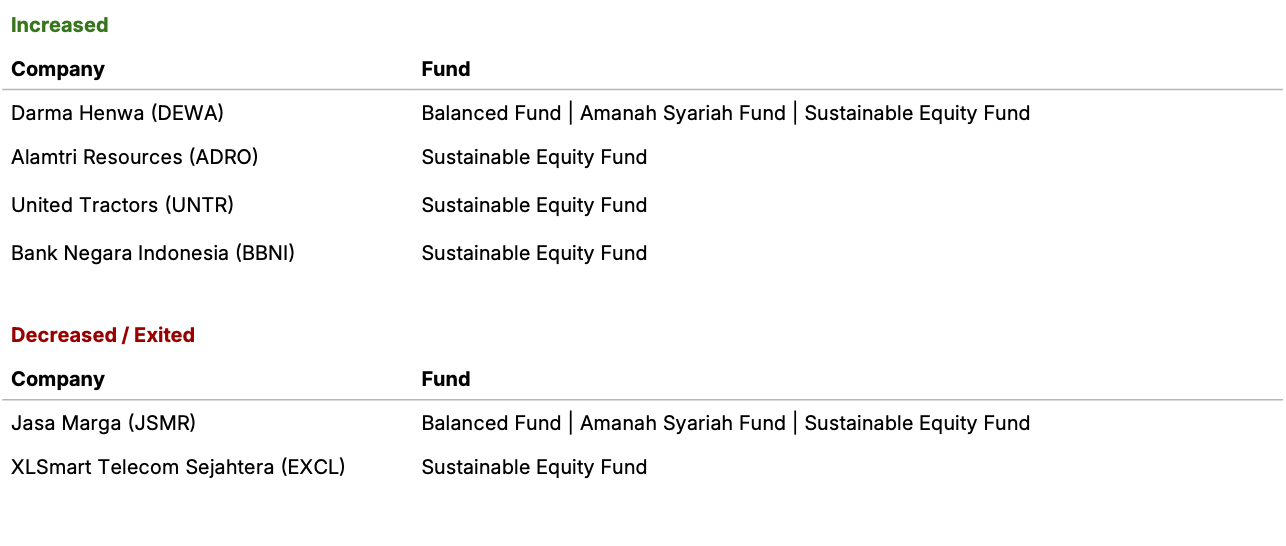

Key Trades of the Month

Below is a quick snapshot of our key trades during the month. For the full story behind each move, check out our December Monthly Investor Update.

Our Outlook

In January, we maintain a constructive outlook but remain aware of near-term risks. Seasonal patterns in January indicate stronger equity performance; however, a potential uptick in December inflation from stronger consumption could constrain BI’s policy flexibility. Globally, we are watching out for U.S. labour market and inflation data, which will be key in shaping the Fed’s decision.

Here’s how we’re positioning our portfolios:

Fixed Income: Continue to keep our portfolio duration conservative and below the benchmark duration, due to rising fiscal deficit risk.

Equities: Have locked in gains from recent rallies and are keeping higher levels of cash. We remain confident in high-quality blue-chips, but selective on momentum stocks.