BI Kept Rates Unchanged, Investors Stayed Defensive

BI held rates at 4.75%, global rate dynamics shift, and investors rotate defensively into year-end.

Key Takeaways:

BI kept rates steady at 4.75% to prioritize stability over growth, but signals room for cuts in 2026.

JCI declined -1% last week as investors took profit from momentum stocks that rallied earlier during the week.

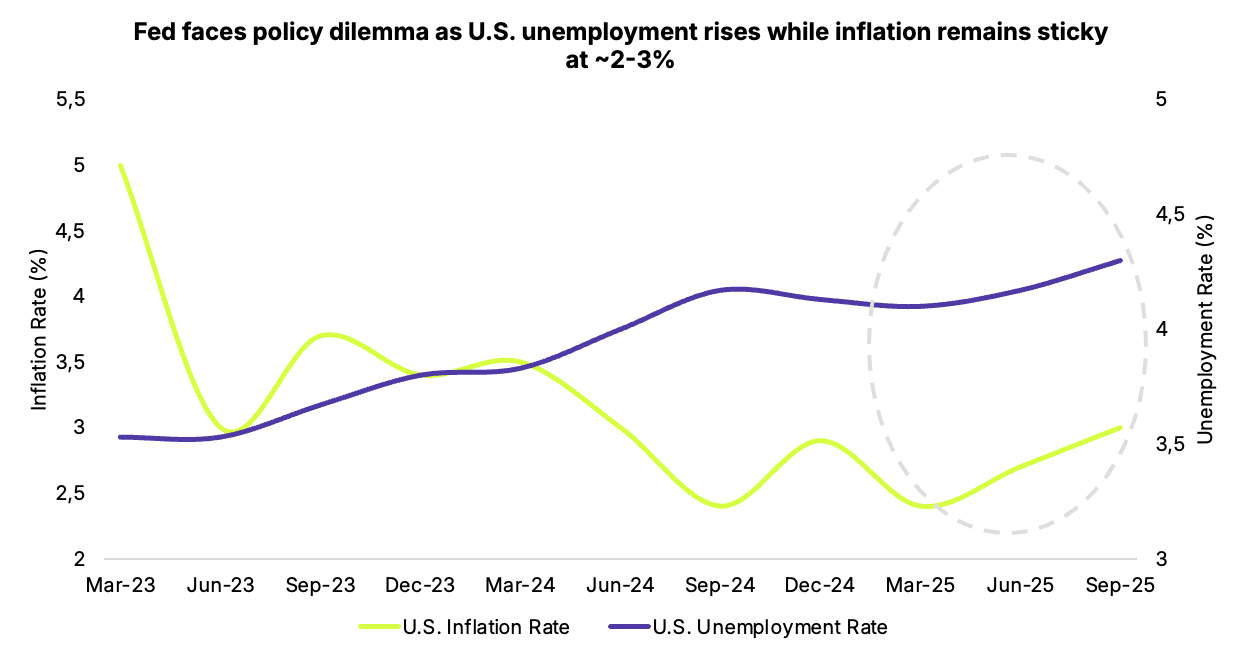

The Fed remains caught between rising unemployment (~4%) and sticky inflation (~2–3%), complicating the policy outlook.

The BOJ lifted rates to a 30-year high, triggering a sell-off in Japanese government bonds and pushing yields higher.

In this environment, we continue recommending investors to remain invested in our Cash Fund.

BI Kept Rates Unchanged at 4.75%

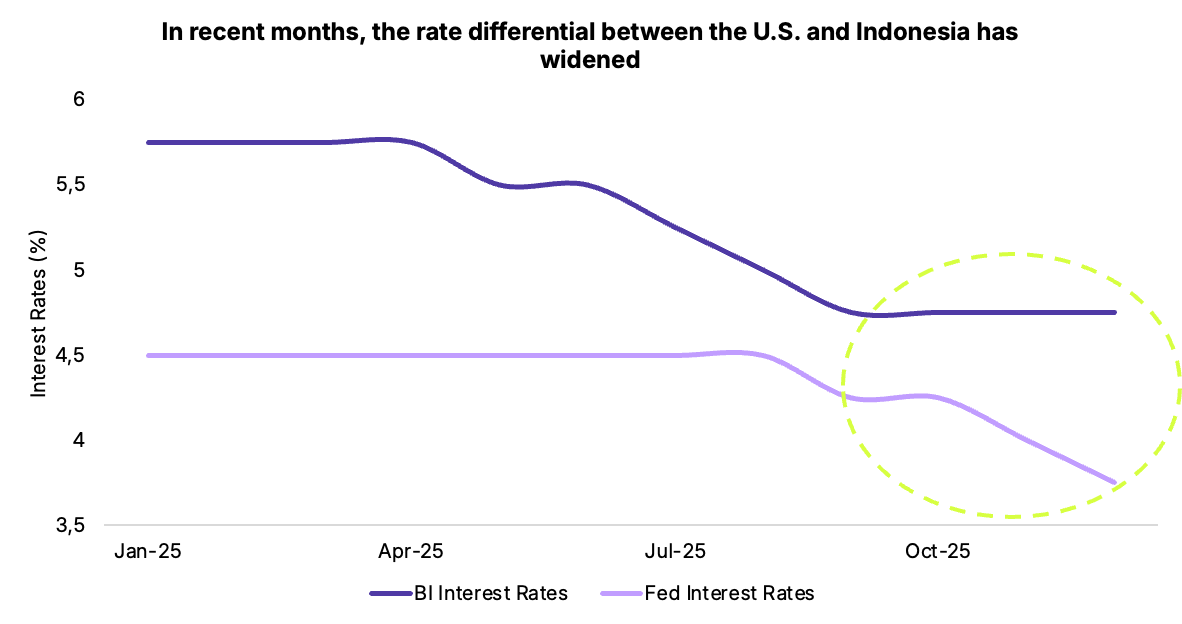

BI kept its benchmark rate unchanged at 4.75% last week, despite the Fed’s recent rate cut. The decision was fully in line with market expectations and therefore had limited impact to the stock market. Currently, the rate differential between the U.S. and Indonesia is 100 bps.

BI reiterated its stance to prioritize stability over growth, citing persistent FX pressure as the USD/IDR hovers at ~16,700. The central bank also emphasized the importance of accelerating policy transmission, urging banks to lower lending rates further amid weak credit demand. Loan growth improved modestly to 7.74% YoY in November from 7.4% in October, but remains below BI’s 2025 target range of 8–11%.

However, BI signaled room for policy easing in 2026, as inflation is expected to remain within the target range of 1.5% – 3.5%. That said, any rate cuts will depend on inflation staying within the target range and global volatility being manageable.

JCI Declined on Profit-Taking

The JCI traded relatively flat during the week then closed out slightly lower by ~1% WoW. Investors engaged in profit-taking ahead of the year-end holidays, a seasonal behavior often observed as investors typically choose to hold higher cash levels and adopt a more defensive stance ahead of the new year.

Momentum stocks extended gains early in the week but lost traction mid-week, reflecting profit-taking and more cautious sentiment following weaker U.S. economic data. Market activity continued to show persistent foreign selling of ~IDR 325.2B, with top foreign sales being BUMI (-7.52%), DEWA (-11.4%), and BBRI (+3.29%).

U.S. Unemployment Rose to Four-Year High

Globally, U.S. labor market data released on Tuesday showed the unemployment rate rising to 4.6% in November, the highest level in four years. This signals a warning sign for the economy and complicates the Fed’s policy outlook, as it faces the dilemma of sticky inflation (from tariffs and supply shocks) vs softening labor market. Actions to fight inflation (raising interest rates) risk worsening the job market, while easing rates for jobs could fuel inflation. Uncertainty is further amplified by the new Fed chairman which would be announced early 2026, adding to market caution around the policy path in 2026.

U.S. equity markets reacted negatively to the data. The S&P 500 fell -0.73% WoW, while the Nasdaq Composite declined -0.16% WoW. The DXY strengthened modestly by 0.32% to 98.72, while U.S. 10Y Treasury yields edged lower to around 4.14%.

BOJ Raised Rates by 25 bps

On Friday, the Bank of Japan (BOJ) raised its interest rate 0.75%, the highest level in 30 years, marking another step in its gradual policy normalization. Despite the hike, the BOJ emphasized that real interest rates remain significantly negative and that financial conditions will stay accommodative to support economic activity.

Following the decision, there was a sell-off in Japanese Government Bonds. 10Y yields rose to 2.1% and 20Y yields rose to 3.02%, the highest level since 1999. The Yen weakened sharply against the dollar and other major peer currencies as the central bank could not offer clarity on future hikes. BOJ Governor Kazuo Ueda remained vague on the exact timing and pace of future rate hikes and only mentioned that Japan should expect further tightening. Meanwhile, Japanese equities responded positively, with the Nikkei 225 gaining 1.28%.

Simpan’s View

Against a volatile global backdrop heading into 2026 driven by Japan’s structural shift and ongoing developments in the U.S., investors are staying cautious ahead of the new year. In Indonesian markets, investors last week took profits from momentum stocks which rallied early last week. We expect this trend to persist through the remainder of the month; as mentioned before, a seasonal behavior is typically observed where investors prefer to hold higher levels of cash before the new year and adopt a more defensive approach.

At Simpan, we continued to trim exposure to momentum stocks that rallied earlier in the week and are maintaining higher cash allocations. We are patiently awaiting a further pullback in the JCI, which we view as likely next year amid elevated uncertainty and volatility. Holding cash positions allows us to deploy capital efficiently into select names once entry points become more appealing.

That said, we maintain our recommendation for investors to remain invested in our Cash Fund. Despite the recent pullback, market levels remain relatively elevated, and we recommend investors to wait for a further pullback before rotating into our Equity Fund. In the meantime, the Cash Fund allows investors to earn modest returns while keeping capital flexible and ready to be deployed.