Fed Cut Rates, Markets Rally

This week in markets: Fed rate cut, domestic flows, and JCI at record highs.

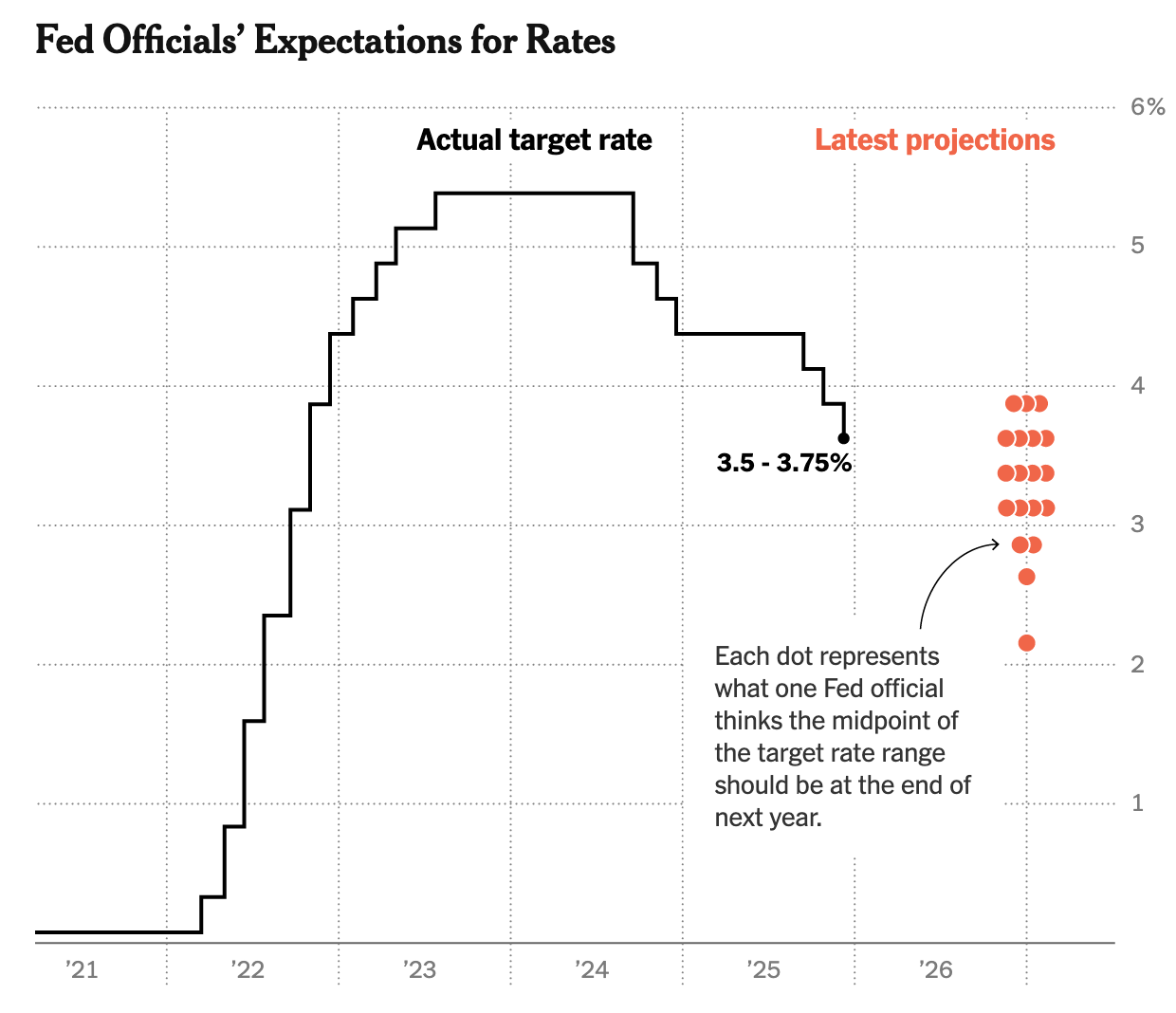

Fed Cut Rates By 25 bps

The Fed cut rates by 25 bps yesterday, the third reduction this year, bringing the benchmark down to 3.50% – 3.75%. The Fed also announced that they would resume purchasing Treasury securities and begin to buy $40 billion in T-bills starting Friday. Notably, the Fed’s rate decision was not unanimous, with three members voting “no”. This has not happened since September 2019, signaling that policy debates may intensify from here. While economists’ projections still point to one cut in 2026, the path forward will depend heavily on incoming economic data, particularly inflation and labor-market conditions.

Source: The New York Times

Although markets had expected the cut, investors cheered and global markets edged higher. The S&P 500 rose 0.67% to a new record high, the Nasdaq Composite gained 0.41%, and the Dow Jones increased by 1.05%. Meanwhile, U.S. 10Y yields slipped to ~4.13%, and the DXY weakened to roughly 98.6.

With a global rate-cutting cycle in place, the macro backdrop for 2026 remains supportive for risk assets. Declining U.S. yields are likely to shift investor appetite towards higher-yielding assets in emerging markets, including Indonesia. That said, we have not been seeing meaningful foreign flows as investors remain cautious amid Indonesia’s new political landscape. However, as policy direction becomes clearer next year, we expect this uncertainty to ease, potentially opening the door for renewed foreign participation, bolstering inflows into Indonesian markets and supporting the Rupiah.

JCI Hit An All-Time High… Again

Asian markets rallied alongside the U.S., and the JCI continued its climb. The index again reached a new high of ~8,776 on Thursday, supported by firm domestic liquidity, a healthier macro backdrop, and the Fed’s rate cut. Buying activity remained concentrated in momentum names, with flows continuing to drive short-term performance. Year-end dynamics such as the “window dressing” phenomenon and the “Santa Claus rally” are likely to be some other main drivers intensifying retail participation.

Foreign investors were net buyers during the week, purchasing IDR 380.75B worth of Indonesian equities (data is as of December 11, 2025). During the week, top foreign buys were BUMI (+50%), DEWA (+31%), and WIFI (+10.1%), while top sells were BBRI (-1.63%), RAJA (-0.76%), and EXCL (+15.62%).

In economic headlines, Indonesia’s latest retail sales report reinforced the positive outlook for household consumption. Retail sales grew 4.3% YoY in October, accelerating from 3.7% in September. This indicates stronger consumer demand, a seasonal pattern usually observed heading into the holiday season.

Simpan’s Views

While the macro environment for 2026 looks favorable, we do not recommend rotating into Equity Funds at current levels. With the JCI at all-time highs, we recommend waiting for a pullback before adding equity exposure.

We also do not recommend moving into Bond Funds yet. Indonesian 10Y yields remain near 6.19%, still below the ~6.5% level we highlighted in our previous article as a more attractive entry point. We prefer to stay disciplined and wait for yields to inch closer to that range before recommending it to investors.

Given the lack of appealing entry points across major asset classes, we advise holding higher cash levels and allocating to our Cash Fund. It provides daily liquidity and competitive yields for your idle cash, while waiting for clearer opportunities. Once market conditions offer better entry levels, we will be sure to give an update.