Why Home Bias Can Erode Your Wealth

Home bias feels safe but it can cost you returns. Explore how thinking globally helps secure your wealth for the next generation.

[For accredited investors only] Many investors unknowingly fall into home bias. The tendency to allocate most of their portfolios to domestic or familiar regional assets, rather than diversifying globally. While it may feel safer to stay close to home, the comfort comes at a cost.

The Tradeoffs of Home Bias

Concentration risk – Over 50% of the JCI’s market capitalization is concentrated in banks and commodities. In contrast, the MSCI ACWI Index spans a broad range of sectors including technology, financials, and industrials, offering more balanced exposure.

Weakening currency – The Indonesian Rupiah has weakened by around 3% annually against the U.S. Dollar over the past 15 years, while remaining highly volatile.

Lower returns – Over the long run, global and U.S. equities have outperformed Indonesian equities, supported by deeper and more diverse capital markets.

Limited diversification – No single asset class outperforms forever. Diversifying across global asset classes reduces portfolio risk and enhances long-term returns.

Smaller, less liquid markets – Indonesia’s capital markets are modest compared to global peers in size, liquidity, and dynamism. Broader market depth helps deliver more consistent, outsized returns.

A proven model: Harvard’s Endowment Fund – Global endowments like Harvard’s provide an excellent example for family offices and long-term investors. By investing across private and public markets globally, Harvard has achieved steady returns with lower volatility over decades.

Why It Matters

Home bias quietly erodes wealth and limits potential:

Indonesian assets generate returns in Rupiah and are tied to local economic cycles.

Global diversification helps offset IDR exposure and domestic income risks.

Building a globally diversified, endowment-style portfolio can help preserve and grow wealth across generations.

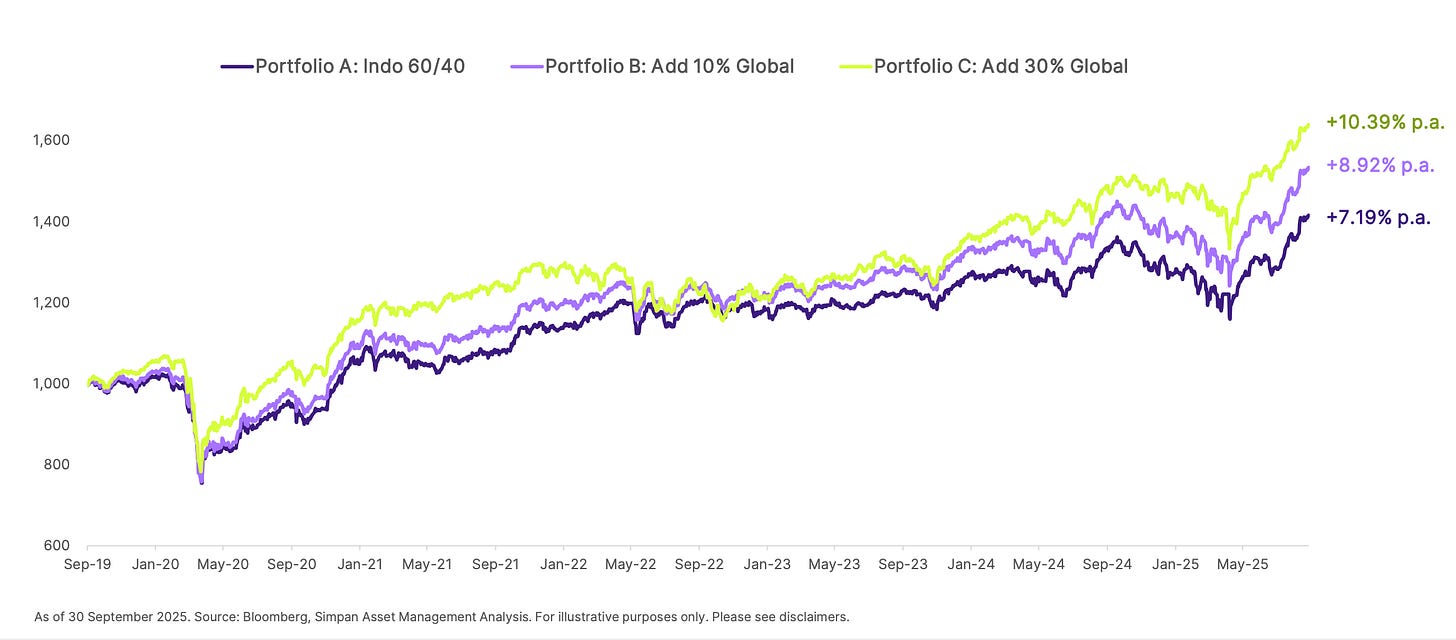

What If We Got Rid of Home Bias?

Adding just 30% global stocks to an Indonesian portfolio has been shown to boost annual returns by +3.2% — a significant improvement through better diversification and currency balance.

Consider building your own version of the Harvard Endowment, a portfolio designed not just to grow, but to last.

Get more insights from our Co-Founder, Nick, in the full video: Watch the 8 minute video