Rate Cuts, Market Highs, and Your Next Move

From surprise rate cuts to the JCI’s record high, markets were full of milestones this week. Let’s unpack the key events and why they matter.

The Week in Markets, Simplified

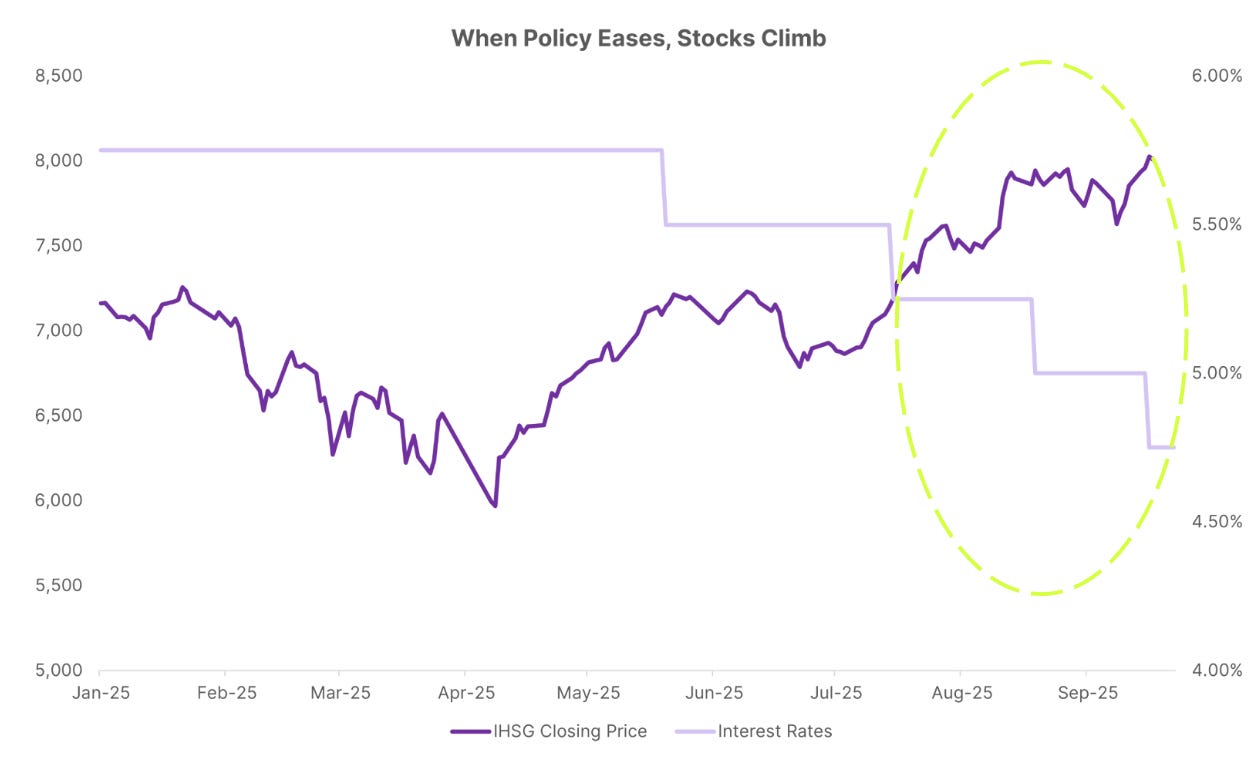

On Wednesday, Bank Indonesia surprised the market with a 25 bps rate cut, bringing the benchmark down to 4.75%. The move signals a pro-growth stance while still prioritizing rupiah stability — a balance that leaves the door open for more cuts if conditions allow. It also makes last week’s IDR 200T liquidity injection cheaper to fund for banks, trimming their cost of funds and helping money flow more smoothly through the system.

Politics added another twist as President Prabowo Subianto once again reshuffled members of the cabinet. Markets, however, focused on the positive: the JCI surged past the 8,000 level for the first time ever, hitting a record high of 8,068 before easing slightly as some investors likely took profits. Globally, the Fed also cut rates by 25 bps, giving an extra boost to the rally.

What This Means for Your Portfolio

Here’s how we see things shaping up across different time horizons:

Bond Fund

For short- to medium-term investors, we recommend exploring our Bond Fund. Lower deposit rates make bond yields more appealing, and our Bond Fund is positioned to benefit.Equity Fund

If you’re in it for the long run, equities remain exciting. The JCI hitting all-time highs, combined with Fed easing and potentially more cuts ahead, gives us confidence that the rally could continue. We remain highly convicted in our stock picks to capture this momentum.

The Bottom Line

With rates moving lower and markets showing strong momentum, this is a turning point worth paying attention to. Whether you’re keeping cash flexible, seeking steady income, or chasing long-term growth, there are opportunities to consider across our funds.

Thank you for keeping up-to-date with our investing and market insights. We are at your service. Should you need any assistance in opening an account, contact us here.