Putting Your Money in the Bank Only Is the Safest… Loss

Putting your savings in the bank feels like the safest option, but is it really?

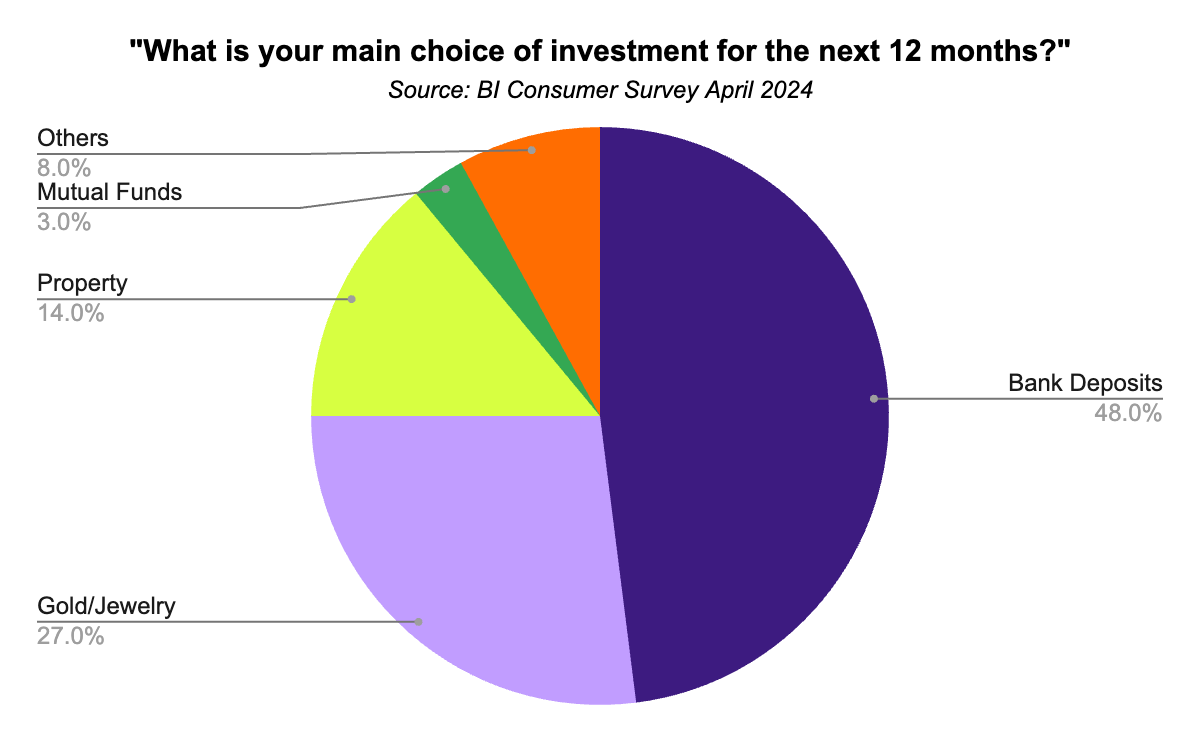

If you ask the people around you, “Where do you usually keep your savings?”, chances are, most will say bank deposits. And that’s not just a guess. A 2024 survey by Bank Indonesia showed that the main choice of investment for Indonesian households are bank deposits (48%), far ahead of gold, property, and equities/mutual funds.

There’s absolutely nothing wrong with saving in the bank. It feels safe, predictable, and convenient. You see your balance go up every month, and you don’t have to deal with the stress of following market news.

But here’s what most people don’t realize: even though your balance increases, your purchasing power – the real value of your money – actually goes down over time. Why?

Meet Inflation: The Silent Thief

Every year, the prices of everyday goods go up, and that’s inflation. Your favorite coffee, fuel, groceries – everything costs a bit more than it did last year. Ten years ago, Rp 100,000 might have covered a nice dinner. Today, it might only get you coffee and snacks. That’s the effect of inflation: your money buys less over time.

From 2015 to 2025, Indonesia’s average inflation rate has been around 3.25% per year, while the average 3-month bank deposit rate is about 5.20%. That means your “real” gain is only about 1.95% per year. In some years, the inflation rate is even higher than the bank deposit rate, meaning that you are actually losing money by putting it in bank deposits.

When you put all your money in the bank, it might feel like the safest choice. But over time, inflation quietly eats away at your hard-earned savings.

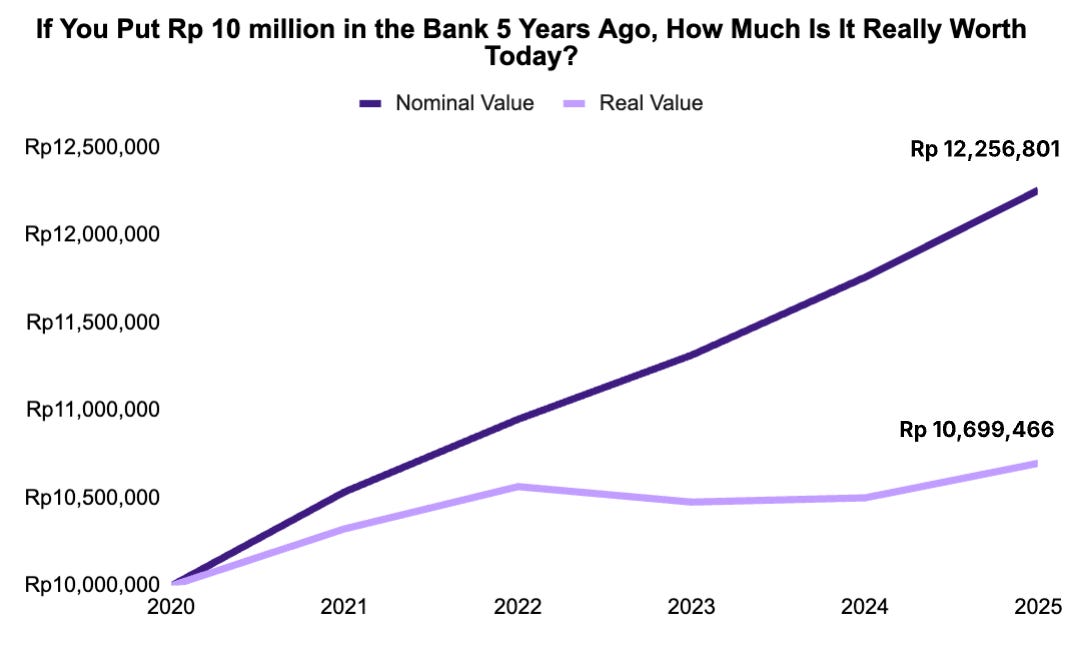

Let’s put this into perspective: if you put Rp 10,000,000 into bank deposits in 2020, your nominal value (value stated in current money without adjusting for inflation) would be ~Rp 12,250,000 in 2025. But your real value (value after adjusting for inflation) is only about Rp 10,700,000, meaning your “real” gain is only Rp700,000. Although your balance went up, your purchasing power barely grew.

So what if there’s a smarter way — one that’s still low-risk, but helps your money grow a bit faster?

How Simpan Makes It Even Simpler to Grow Smarter

You don’t need to be an expert to make your money work a little harder. At Simpan, you don’t have to pick and manage products yourself. Our money market portfolio — tactically curated by our investment team — combines quality deposits and short-term bonds in one ready-made, well-managed portfolio.

That means:

You’re not buying separate products, you’re investing in a strategy.

You’re free from deposit restrictions like lock-ins or minimum terms, so your money stays flexible.

You get institutional-level management designed to keep your money secure while earning potential returns above typical deposits.

With Simpan, your short-term money doesn’t just sit still — it works, safely and intelligently.