Monthly Investor Update September 2025

A monthly rundown of how the markets moved, how our funds performed, and our outlook ahead.

Key Takeaways:

Markets swung from panic to record highs after policy boosts and rate cuts.

Fund performance was mixed — money market steady, equities lagged.

We’re staying selective, favoring high-yield bonds and blue-chip stocks for long-term value.

To access the full report, click here.

September’s Market Recap: From Panic to a Record High

September was a wild month for markets. A cabinet reshuffle — including the replacement of Finance Minister Sri Mulyani — initially sparked panic, sending the Rupiah lower and the JCI down -1.3% in a day.

But sentiment flipped fast after the new Finance Minister announced a IDR 200T liquidity boost and Bank Indonesia followed with a rate cut, alongside the Fed. As these moves were intended to boost economic growth, investors cheered and the JCI rallied, hitting record highs.

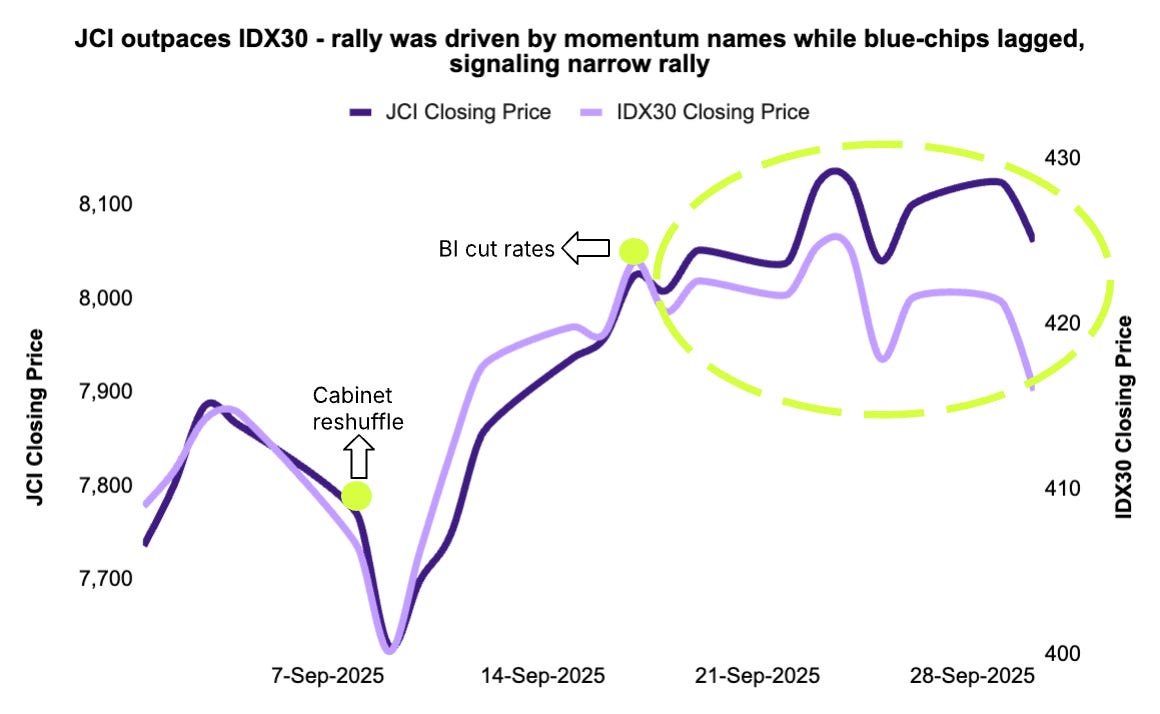

Here’s the catch: the rally was not even. Although the JCI rallied, the chart below shows that the IDX30 (an index that tracks blue-chip stocks) lagged behind. Since the JCI contains both blue-chips and momentum stocks, the widening gap implies that the rally was led by momentum names.

How Our Funds Performed

Our funds traded mixed in September. Here’s the quick breakdown:

Money Market: Delivered stable and positive returns, outperforming benchmarks.

Equities: Lagged. Though the JCI rallied, much of the action was driven by momentum stocks outside our portfolio.

Fixed Income (Bond Fund): Mixed performance – 10Y yields went up, but 5Y tenor declined.

Looking Ahead: Our Outlook and Game Plan

Given the positive catalysts in September, we expect stocks and bonds to benefit as confidence improves.

Fixed Income: Staying cautious — With foreigners still selling and the Rupiah under pressure, we’re focusing on bonds that pay higher interest while avoiding too much risk on longer maturities.

Equities: Gradually adding blue-chip stocks with solid fundamentals, while being selective on momentum names after their sharp run-up.

Thank you for keeping up-to-date with our investing and market insights. We are at your service. Should you need any assistance in opening an account, contact us here.