Monthly Investor Update October 2025

A monthly rundown of how the markets moved, how our funds performed, and our outlook ahead.

October Market Recap

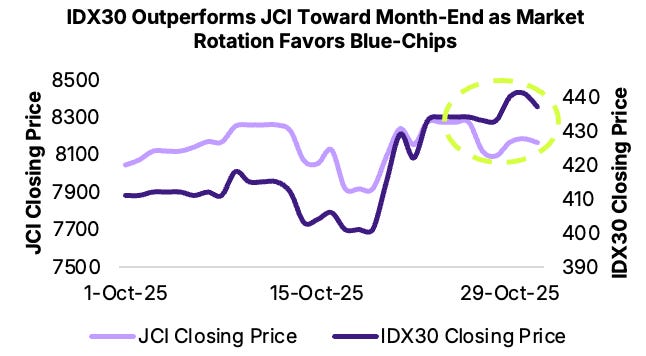

In October, Indonesian markets continued to rally in initial weeks, with the Jakarta Composite Index (JCI) climbing to a new high of 8,354, lifted by strong gains in conglomerate stocks. Toward month-end, however, markets took a turn. The JCI saw a sharp pullback, driven by broad profit-taking in conglomerate stocks, renewed U.S.–China trade tensions, and MSCI’s plan to tighten index rules.

Investor appetite shifted to blue-chip stocks following BBCA’s strong earnings and attractive sector valuations, which drew renewed foreign inflows. Meanwhile, Bank Indonesia kept rates steady at 4.75% to support the Rupiah, while the U.S. Fed delivered another rate cut to keep growth on track.

How Our Funds Performed

All of our funds delivered positive returns in October, although some lagged benchmarks.

Money Market: Continued to outperform benchmarks and deliver stable returns.

Equities: Positive momentum amid notable rotation into blue-chip stocks.

Fixed Income: Remained stable despite ongoing foreign outflows.

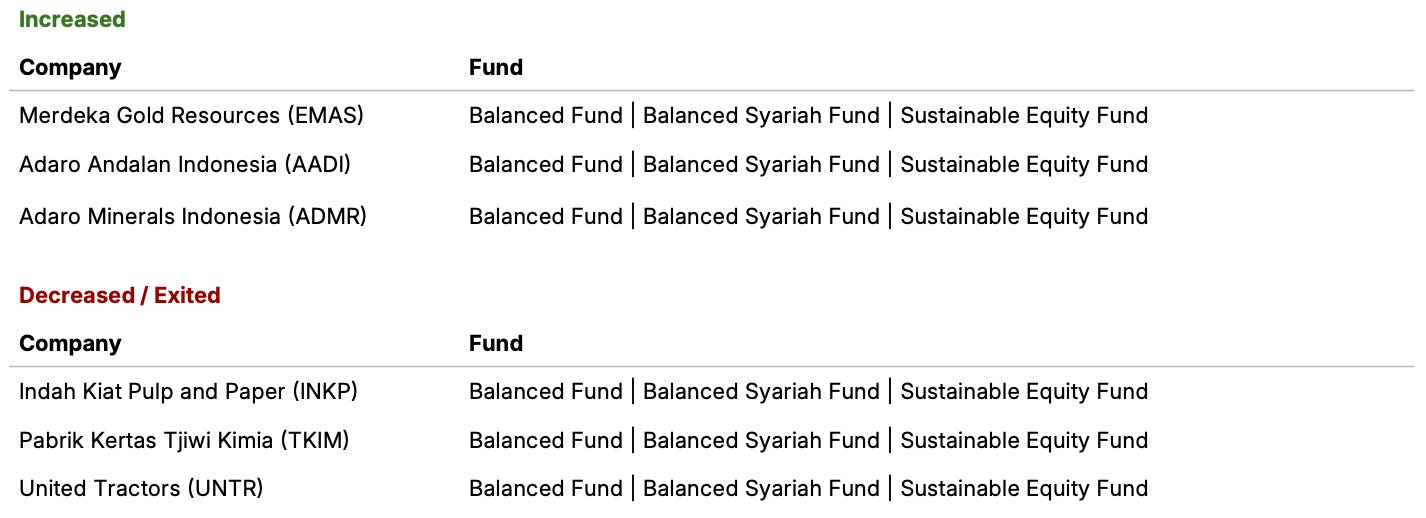

Below is a quick snapshot of our key trades during the month. For the full story behind each move, check out our October Monthly Report.

Or click here for the Indonesian version.

Looking Ahead: Our Outlook and Game Plan

Looking ahead, we expect equities to outperform, given positive catalysts like supportive policies from the MoF and BI, as well as the recent Fed rate cut.

Fixed Income: Continue to stay cautious, favoring high yield bonds.

Equities: Continue leaning towards blue-chip stocks, while being more selective with momentum stocks.