Monthly Investor Update August 2025

Discover key highlights from Simpan's August 2025 Investor Update: market moves, portfolio positioning in bonds and equities, and our outlook on Indonesia and global trends.

August wasn’t the easiest month for investors. Indonesian equities came under pressure as foreign funds shifted back into blue-chip names, and late-month political and social unrest added to the uncertainty. On the brighter side, bonds had a strong run, supported by falling yields and steady foreign inflows. Globally, the US showed a sharp rebound in growth, while Bank Indonesia surprised with a rate cut to keep the economy supported.

Monthly Market Recap

Indonesia’s economy grew 5.12% in 2Q25, faster than the previous quarter, thanks to strong investment and steady household spending.

In the US, core inflation edged up to 3.1%, mostly due to higher housing costs, while growth bounced back strongly with GDP up 3.3% after contracting in Q1.

Back home, Bank Indonesia surprised with a rate cut to 5.00% to support growth, as the Rupiah held firm around 16,200 per US dollar.

Toward the end of August, sudden political and social unrest hit local markets, triggering sell-offs in equities and bonds—though interestingly, the Rupiah strengthened against the dollar.

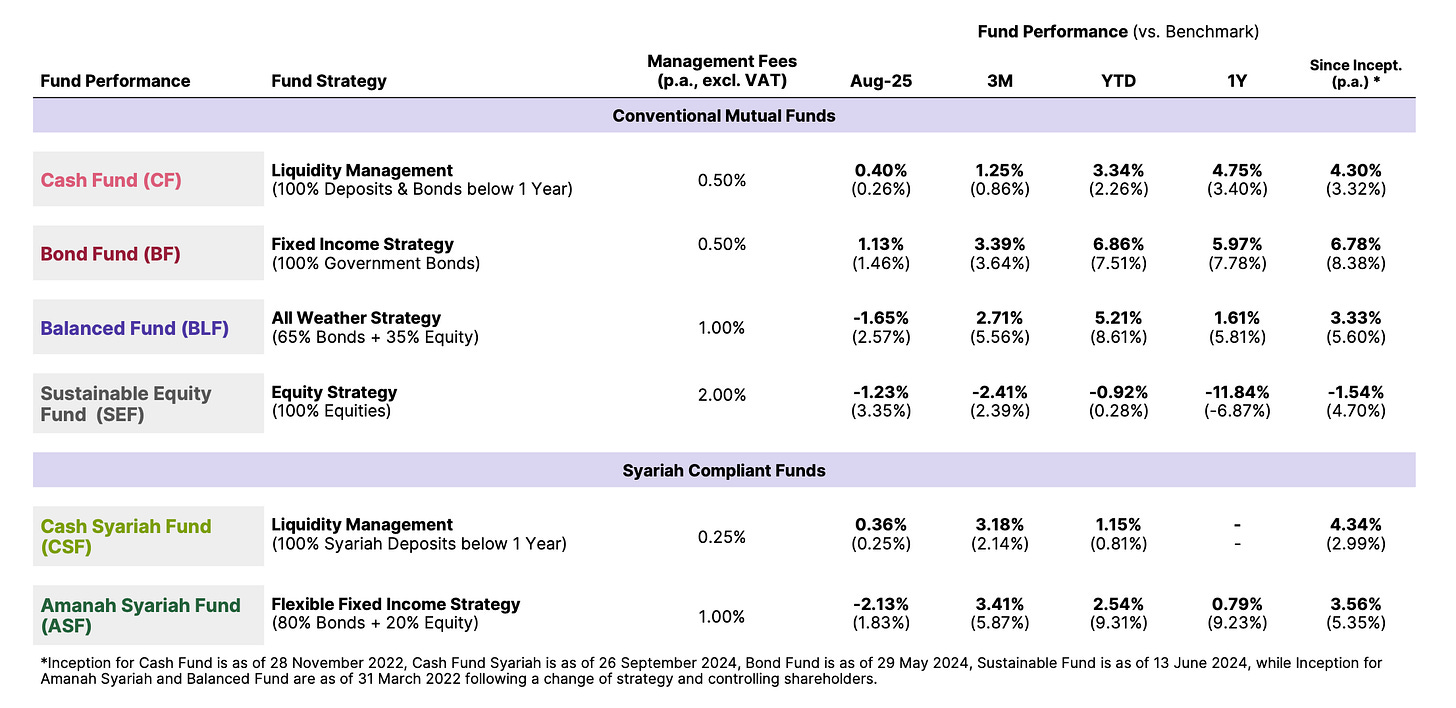

What This Means for Your Portfolios

In Fixed-Income, we are implementing a medium-to-long duration strategy to capture attractive yields and potential capital gains. Our focus remains on mid-tenor bonds, which provide a favorable balance between risk and return, while we maintain a selective and cautious approach toward longer-dated maturities.

In Equities, we continue to realign the fund toward foreign-proxy names, focusing on high-quality blue-chip stocks, as foreign investors’ aggressive buying is expected to drive valuations higher. While momentum-driven names remain appealing, we see the need for greater selectivity given the gradual rotation of domestic liquidity toward blue-chip counters.

Market Outlook

We expect recent domestic unrest to ease, keeping the economy broadly stable, with a possible BI rate cut ahead to support the Rupiah and growth. Globally, the Fed is likely to start easing in 3Q25, but Trump’s proposed tariffs could add fresh uncertainty to the trade outlook.

Thank you for your continued trust.

Read the full report in English here.

Baca laporan selengkapnya di sini.