Macro Outlook 2026

5 key themes our Investment Team is watching in 2026.

Dear Simpan Client,

We are pleased to share our 2026 Macro Outlook, highlighting five key themes shaping the investment landscape in 2026. Access the full report here.

Domestic Outlook

1. Fiscal and Monetary Policy Alignment: Kickstarting the Growth Engines

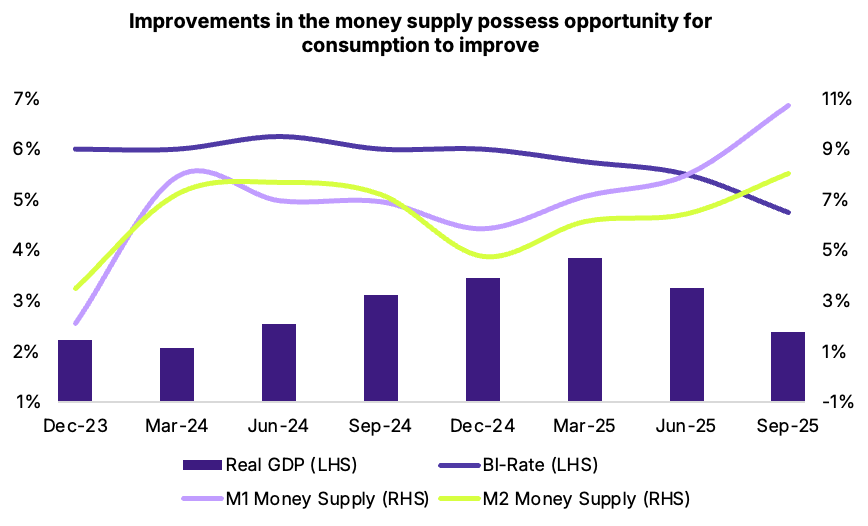

Indonesia’s structural growth remained intact in 2025 with >5% annual GDP growth, driven by underpenetrated industries, rising productivity, and a favorable demographic profile.

In 2026, Indonesia sees forecasted GDP growth of 5.1% YoY, supported by more accommodative fiscal and monetary policies.

Danantara will be a major catalyst for growth, although it will take time for the full effects to be realized.

2. Domestic Investors as the Savior of Bond Yields – The New Normal

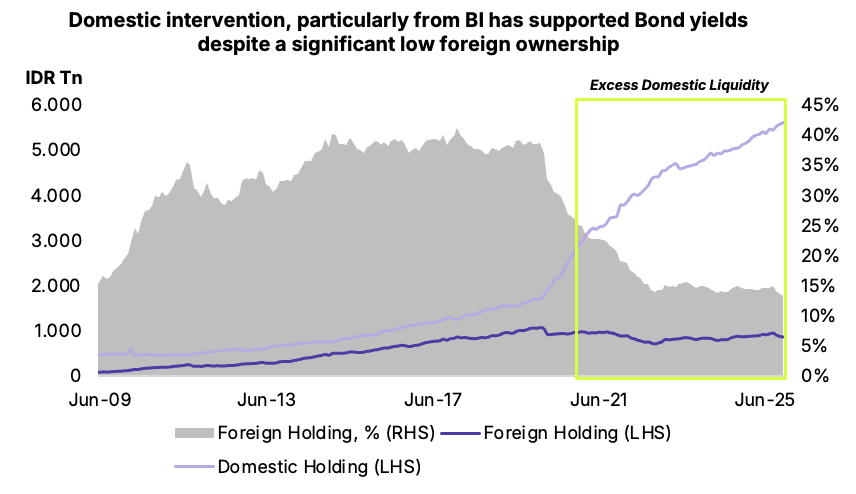

Foreign ownership of Indonesian Government Bonds declined in 2025, falling to ~14% of total issuance. However, impact to yields have been minimal, with yields staying stable or sometimes even declining.

Indonesia’s bond market sees resilience in the coming years as domestic investors step in to absorb supply.

However, we think that mid- to long-term yields could rise slightly due to the government’s economic agenda, given the widening fiscal deficit and weakening Rupiah.

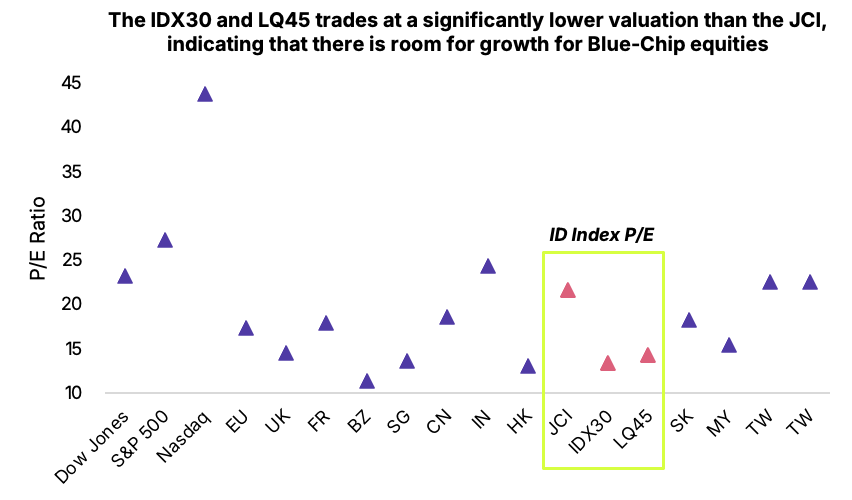

3. Shifting Tides: From Momentum Stocks to Blue-Chips

In 2025, the JCI broke through record highs multiple times, driven by momentum stocks. However, blue-chips stayed quiet as foreign flows were muted.

With blue-chip valuations at multi-year lows, a cyclical earnings recovery underway, and global liquidity conditions becoming more supportive, 2026 offers a strong setup for a potential reversal in flows back into Indonesian blue-chip equities.

Global Outlook

4. U.S. Resilience Poised To Extend Into 2026

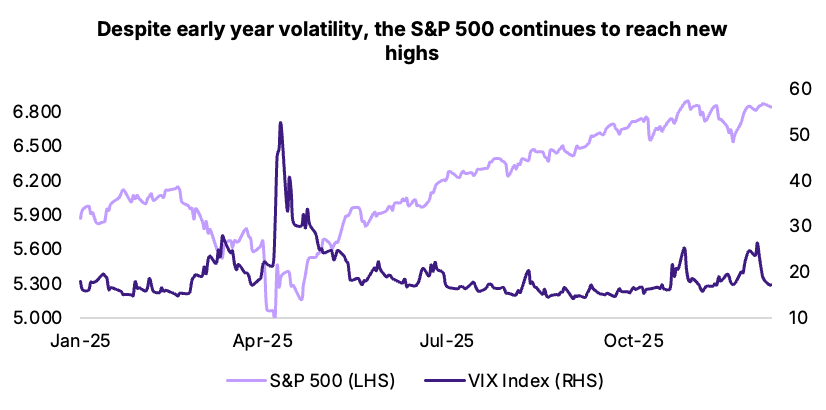

Global markets (especially the U.S.) saw turbulence in early 2025 due to trade tensions and tariff announcements.

However, risk appetite soon recovered with major indices (S&P 500, Nasdaq Composite) rallying to new highs. Gains were largely driven by the Technology sector, as AI-related names continued to dominate the narrative.

A global rate-cutting cycle and reduced policy uncertainty should improve investor sentiment and drive flows in 2026. However, elevated valuations leave equities more vulnerable to negative surprises, suggesting that 2026 might see volatility and moderate returns compared to this year.

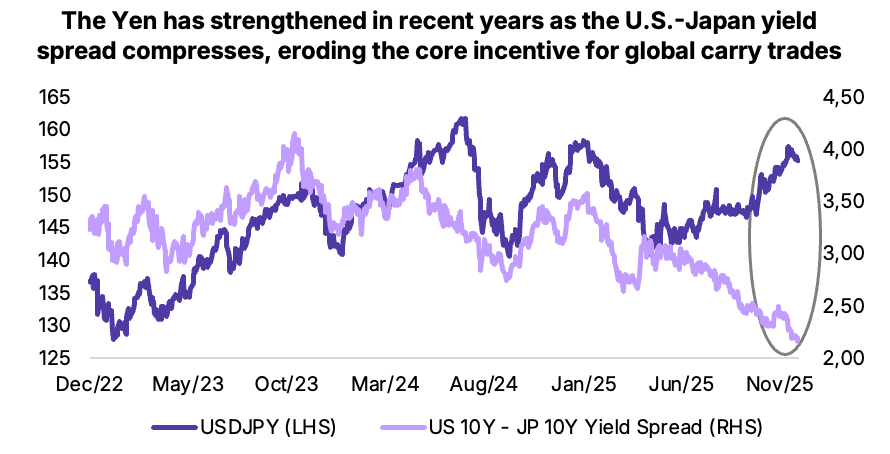

5. Unwinding The Yen Carry Trade, What’s The Alternative?

Economic structural changes in Japan dismantle the foundations of the Yen carry trade.

As the yen loses its funding dominance, markets will have to shift to costlier alternatives, tightening leverage and heightening rate and FX shock risks in 2026.