Lessons from 2025: What The Year Taught Us About Markets

A look back at some of Simpan’s top insights for the year

Dear Clients,

As 2025 comes to an end, we would like to pause and reflect on the key lessons the markets have taught us over the year. In a nutshell, 2025 was defined by policy shifts, tariff headlines, and periods of political uncertainty, both globally and domestically. Yet, markets proved resilient, with major indices ultimately reaching new highs. Below are some of the key lessons we’ve learned.

1. Short-term volatility is often noise

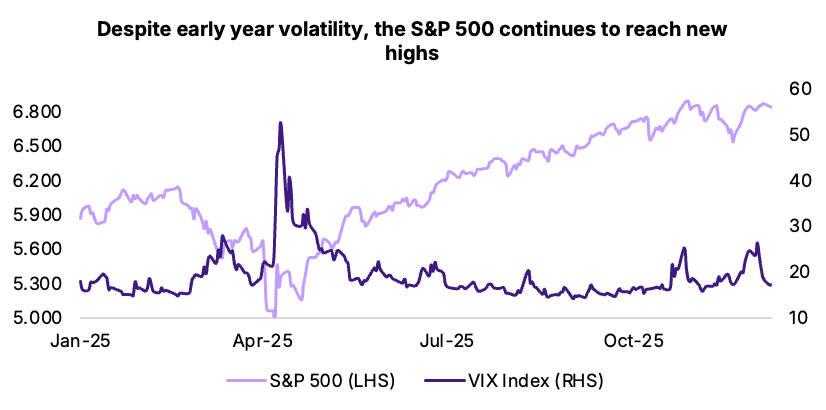

Perhaps one of the most prominent themes in 2025 was tariff-driven volatility following President Donald Trump’s “Liberation Day” announcement in April. Major U.S. indices such as the S&P 500 and Nasdaq Composite fell to early-year lows. Indonesia was affected as well, with several trading halts executed post Lebaran break.

While these events initially unsettled markets, the sell-off turned out to be short-lived. Risk appetite soon recovered as uncertainty eased. By May, markets had stabilized, with U.S. indices rallying to new highs by year-end. Tech continued to dominate the narrative, given robust Q3 earnings and euphoria around AI-related names.

In hindsight, 2025 served as a clear reminder that headlines often drive short-term volatility, but patience and discipline are what drive long-term returns.

2. Market resilience can come from unexpected sources

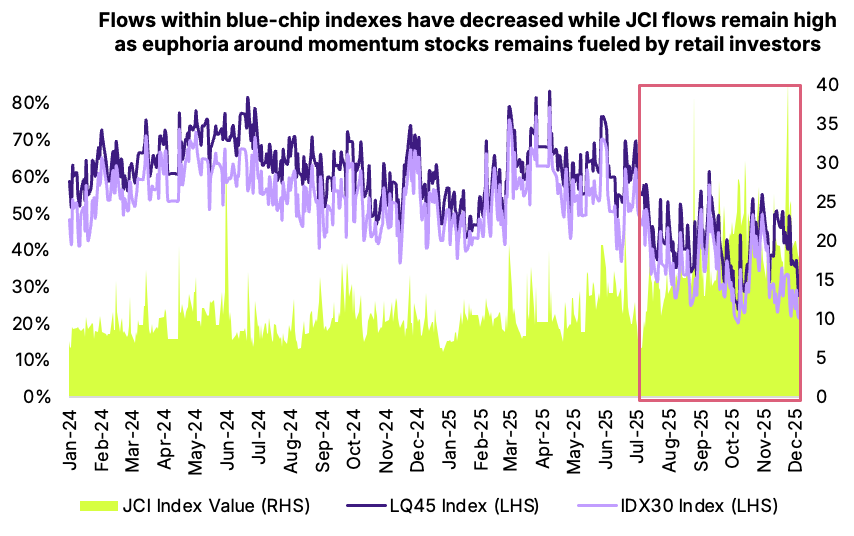

Indonesia experienced its own episode of political uncertainty following the social unrest and cabinet reshuffle announced in August. The new MoF and Indonesia’s new political environment under the Prabowo administration left foreign investors cautious (overall, they were net sellers in 2H’25). Flows to blue-chip stocks were muted. Despite this, the JCI reached record highs, driven by momentum stocks and strong participation from domestic investors.

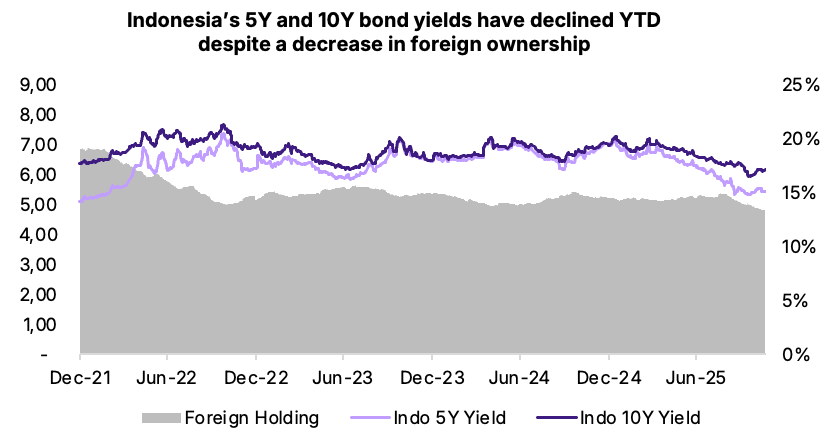

A similar theme played out in Indonesia’s bond market. Even as foreign ownership fell to decade lows, we noticed an interesting case where yields remained broadly stable and in some cases declined. When foreigners sold, domestic institutions stepped in to absorb supply and limit volatility.

2025 challenged long-held market assumptions; markets were not led by foreign flows or blue-chips, but by domestic investors and momentum stocks.

3. Policy intent matters, but transmission takes time

Indonesia’s growth agenda was clear in 2025, but the pace of fiscal transmission was slower than expected. The rollout of Danantara reminded us that large structural initiatives do not always move the economy or markets immediately. Rather, their impact builds gradually before translating into tangible economic activity.

This was also reflected in Bank Indonesia’s policy decisions. After delivering several rate cuts earlier in the year, BI chose to pause amid Rupiah weakness, prioritizing stability while waiting for clearer transmission to credit growth.

Again, 2025 reinforced a familiar theme: new policy changes take time for the effects to be fully realized.

Overall, 2025 reminded us that periods of volatility and uncertainty are often temporary and that change does not always mean risk. Sometimes, it can also signal opportunity. Reflecting on these lessons help us better prepare for 2026, which we believe will be a year marked by resilience, strong growth, and a shift back to quality assets.

As we close out the year, we would like to sincerely thank you for your continued trust. We wish you a joyous holiday season, and a very Happy New Year. We look forward to navigating the opportunities and challenges of 2026 together.