JCI Under Pressure After Strong Rally: What Happened?

After hitting all-time highs, the JCI saw a sharp pullback last week. Continue reading to see what happened and what our Investment Team did.

Key Takeaways:

JCI dropped -3.11% last week; sell-off was driven by profit-taking from investors.

Asian markets were also under pressure, weighed down by rising trade tensions between the U.S. and China.

As equities weakened, investors shifted toward safe assets like Government Bonds & Gold, pushing prices higher.

JCI Fell Last Week, What Caused It?

After reaching new highs in October, the JCI dropped sharply on Tuesday, closing the day lower by -1.95%. There were no economic events or negative headlines driving Indonesian markets lower. Rather, the decline was largely due to investors taking profits from momentum stocks that had rallied strongly in recent weeks. Some popular stocks even hit Auto Reject Bawah (ARB)* on Tuesday, though most stocks managed to recover slightly from intraday lows.

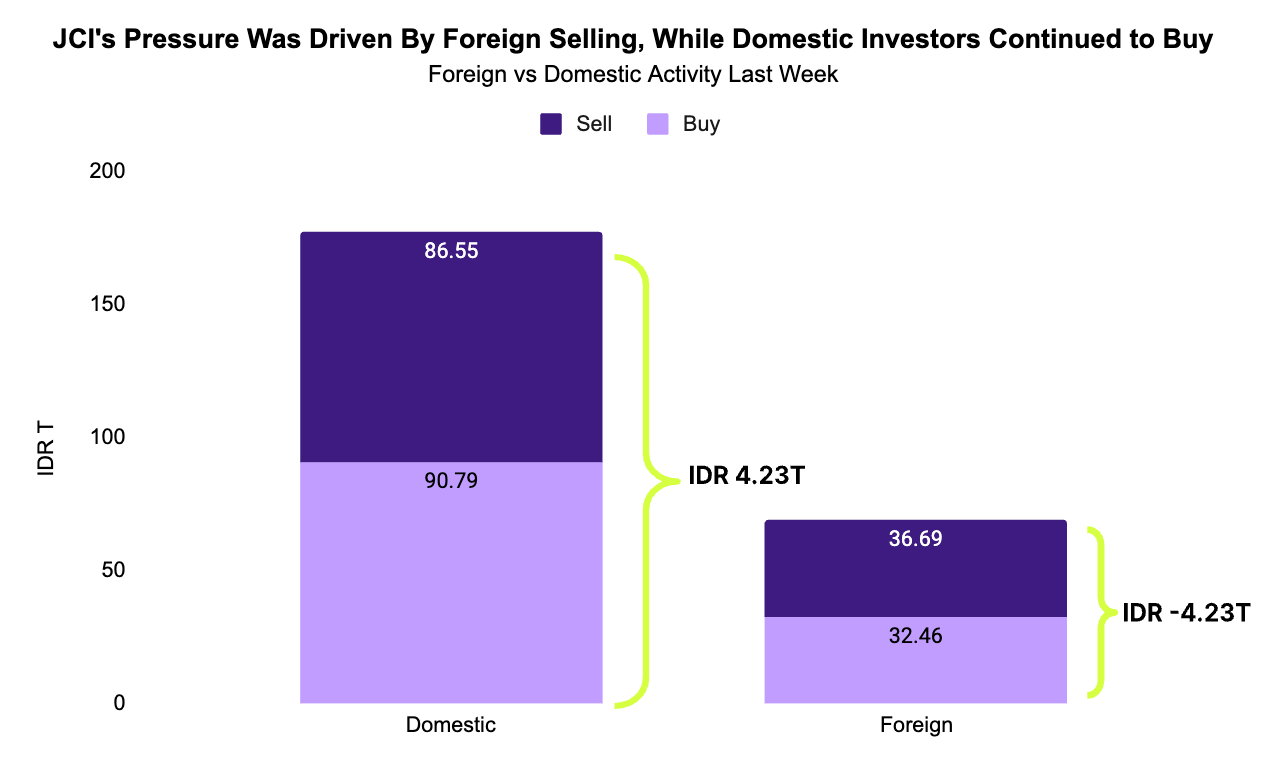

Pressure continued throughout the week. Much of the selling continued to be driven by foreign investors, while domestic investors continued to buy. On Thursday, the JCI rebounded slightly as some investors took the weakness as a buying opportunity. However, demand wasn’t strong enough and markets dropped again on Friday.

*Auto Reject Bawah (ARB) is a trading limit rule on the Indonesia Stock Exchange that prevents a stock’s price from falling beyond a certain percentage in one day. Once a stock hits this lower limit, trading is automatically halted for that stock.

Asia Under Pressure Too

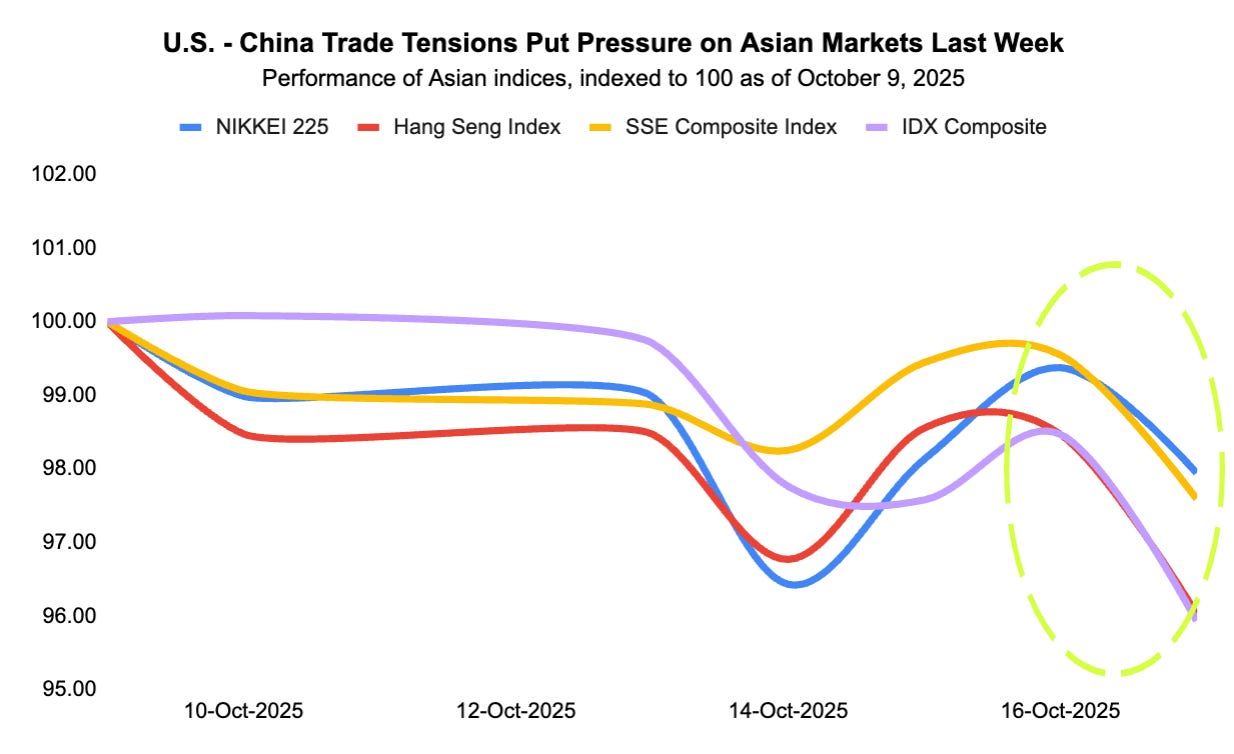

Outside of Indonesia, other Asian markets like Japan, Hong Kong, and China also saw selling pressure last week. Weakness was triggered by concerns over the U.S.–China trade tensions as President Donald Trump threatened to impose 100% tariffs on Chinese goods, reigniting fears of another tariff war.

Although he later softened his tone, mixed signals from China’s Commerce Ministry have kept investors cautious. With no clear resolution in sight, Asian economies remain vulnerable to trade-related volatility, and this uncertainty weighed broadly on Asian markets.

Investors Turn To Bonds & Gold

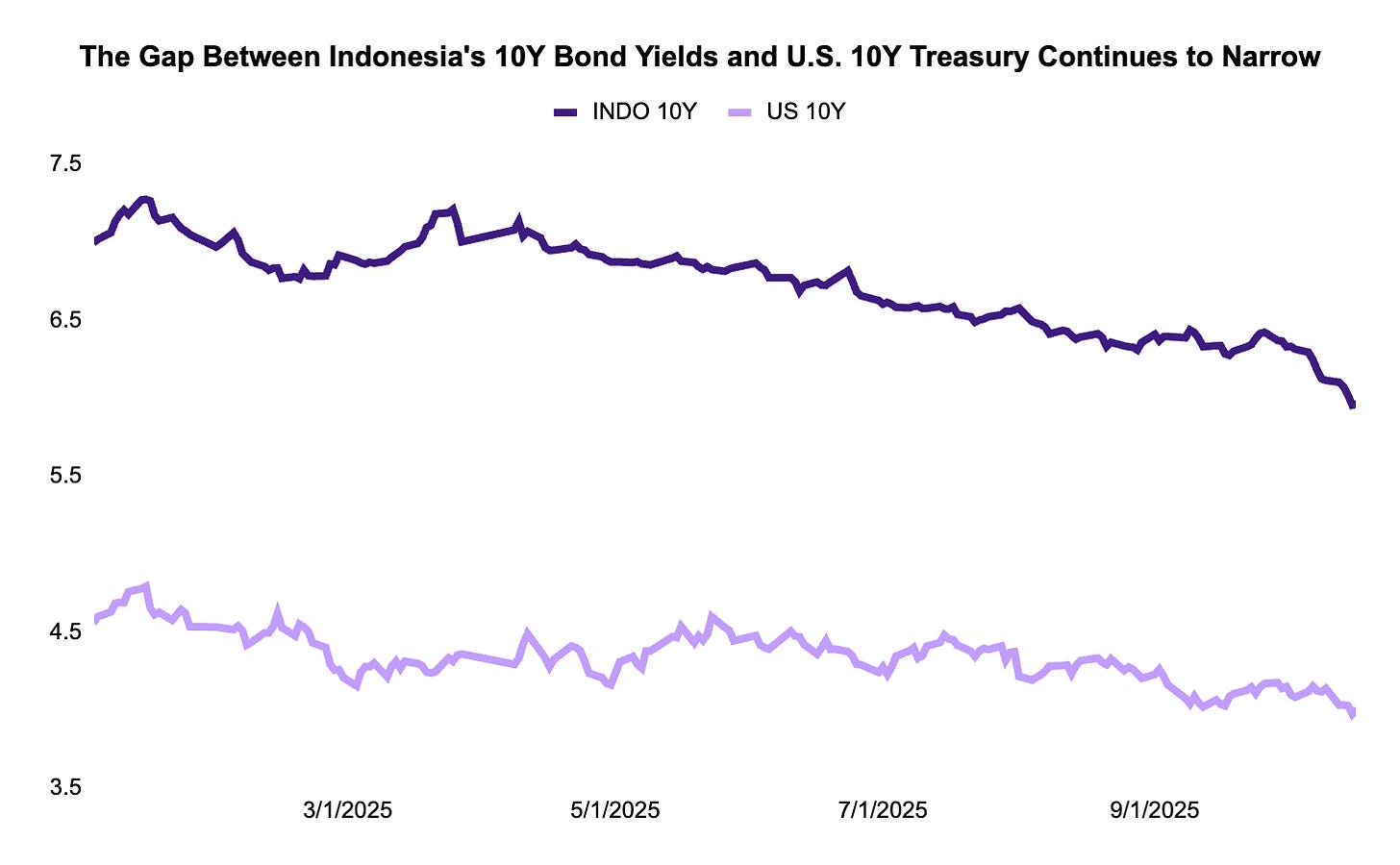

Amid recent uncertainty, investors have been rotating into safe-haven assets such as Government Bonds and gold. In Indonesia, yields have continued to move lower, with the 10-year Government Bond yield around 5.9%, compared to 4.0% for the U.S. 10-year Treasury — the smallest gap in months.

Because bond prices and yields move in opposite directions, falling yields mean bond prices are rising, reflecting strong demand as investors seek stability. Similarly, demand for gold has increased as well, surging to a record high of above USD $4,300/oz last Thursday. The increase in demand is fueled by rising U.S.-China trade tensions and the recent U.S. government shutdown.

Our Next Move

In response to the market correction, here’s what our Investment Team did:

Took the weakness as a buying opportunity and continued rotating into blue-chip stocks

Continue to adopt a “wait and see” stance in Fixed Income – bond prices are still elevated, so we’re holding cash and waiting for better entry levels