JCI Rebounds. This Time, Gains Were Led By Blue-Chips

JCI gained +3.5% last week. Continue reading to see what drove the rebound.

Key Takeaways:

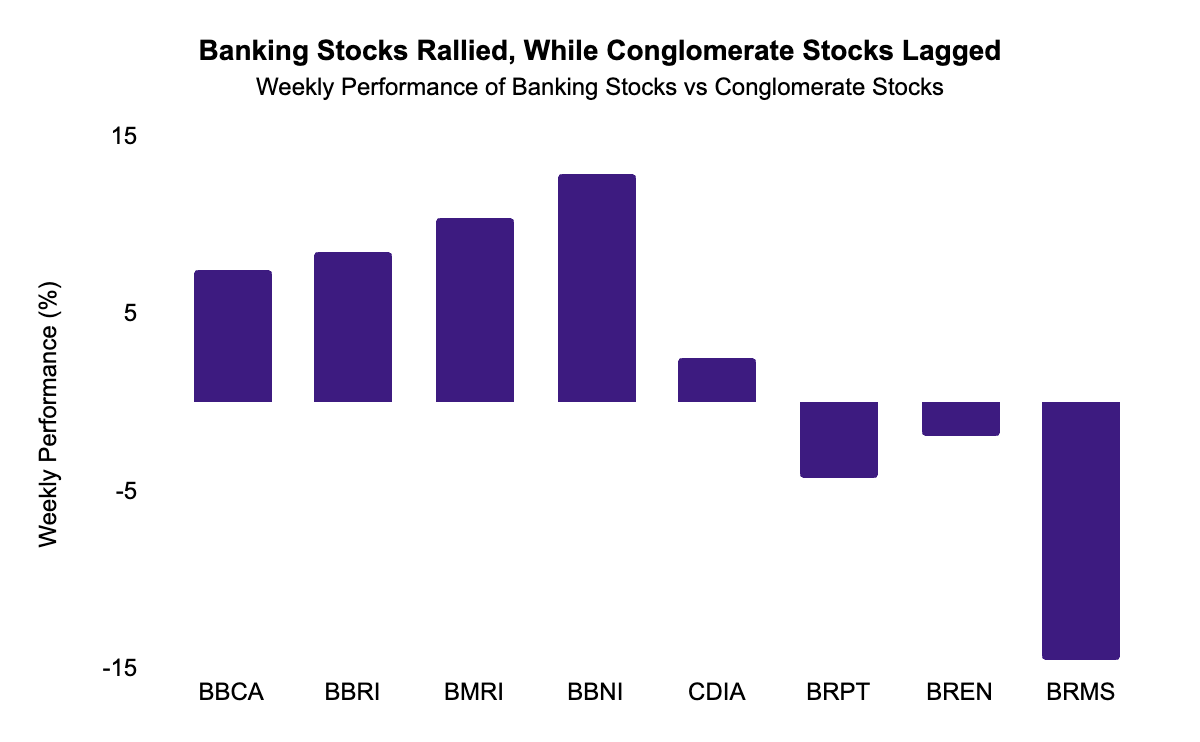

JCI up +3.55% last week; rebound was driven by blue-chip banking stocks as foreign funds flowed in.

Conglomerate stocks stayed quiet as investors continued to take profits from recent rallies.

BI kept rates unchanged, but markets didn’t see much volatility.

Banking Stocks Rallied; Conglomerate Stocks Stayed Quiet

After months of quiet performance, banking stocks roared back last week. BBCA was one of the top gainers, climbing +7.5% week-on-week , after reporting stronger-than-expected earnings and giving an upbeat outlook for the coming quarters. The company also announced a share buyback worth IDR 5 trillion — a move often seen as a vote of confidence from management.

A share buyback is when a company buys back its own shares from the market. It’s generally viewed positively because it signals management’s belief that the stock is undervalued and reflects confidence in the company’s future. After several weeks of foreign selling, foreign investors reversed trend and were net buyers last week, helping fuel the rally in banking stocks.

Other major banks, including BBRI and BMRI, also gained ground as investors were drawn to their attractive 2026 earnings yield forecasts . Simply put, earnings yield measures how much a company earns relative to its stock price. A higher yield suggests the stock may be undervalued, making it appealing to investors seeking good value and potential upside.

Meanwhile, conglomerate stocks stayed quiet as investors took profits from earlier rallies and rotated funds into banking names.

Bank Indonesia Kept Rates Steady at 4.75%

On Wednesday, Bank Indonesia surprised markets by keeping interest rates unchanged at 4.75%, after cutting rates three times in a row. BI said it wants to take time to see how previous rate cuts are impacting the economy before making any new changes. The pause also reflects BI’s effort to keep the Rupiah stable, especially with ongoing uncertainty in global markets.

Although markets had expected another rate cut, the decision to hold rates steady didn’t cause major volatility. Banking stocks dipped slightly on Wednesday but quickly rebounded, extending gains through Thursday and Friday.

Blue-Chips Outshine Bonds

Currently, the IDX High Dividend 20 Index* offers a yield of roughly 7.54%, while the 10-year Indonesian government bond yield sits at around 5.9%. As the index’s yield is higher than the bond yield, it suggests that blue-chip stocks may provide better income potential than government bonds.

If you’re looking for exposure to quality blue-chip stocks, check out our Sustainable Equity Fund. It’s positioned toward blue-chip stocks at attractive valuations, companies we believe are best placed to benefit in today’s market.

*The IDX High Dividend 20 Index tracks the performance of 20 stocks that have distributed cash dividends every year over the past 3 years and have a high dividend yield.