JCI Continues to Reach New Highs. What’s Driving It?

The JCI reached a record high in October. Continue reading to see what's driving the rally.

Key Takeaways:

The JCI hit new highs in October, but the rally is still driven by momentum-driven stocks. Blue-chips remain on the sidelines.

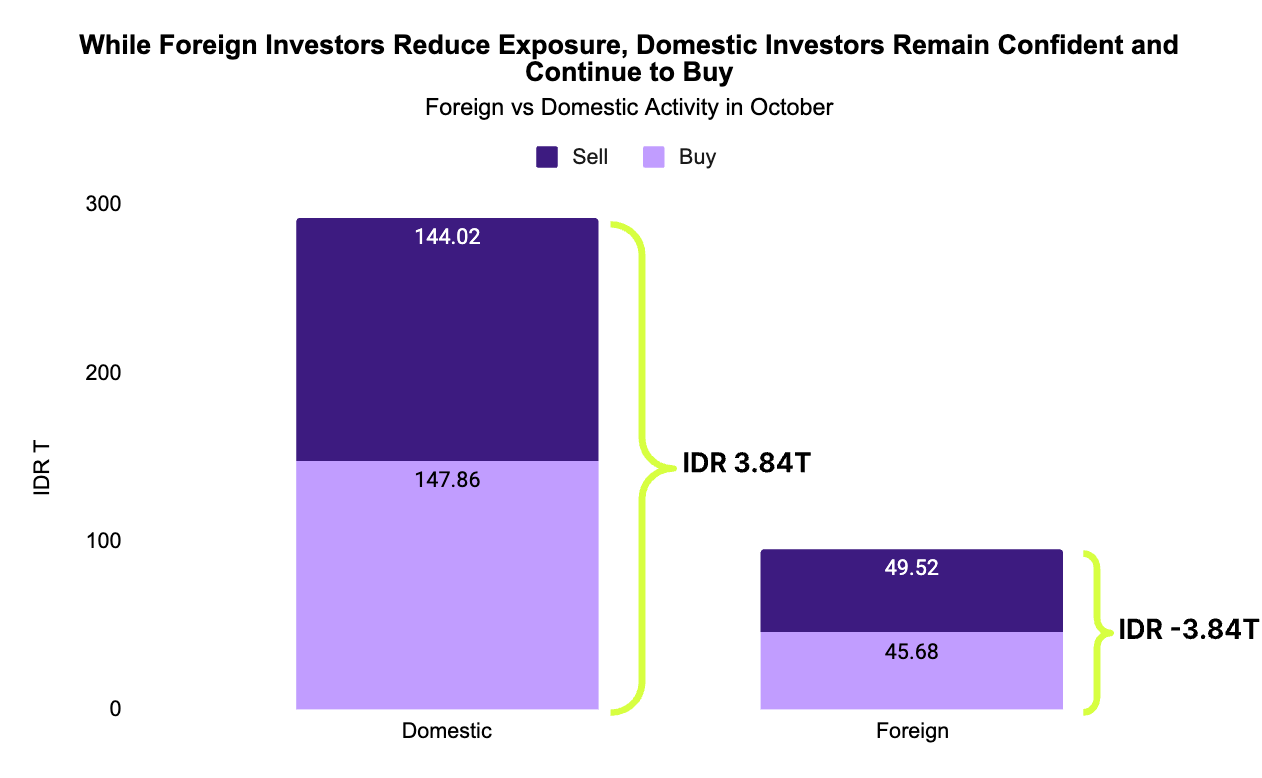

Local investors continue to drive demand, while foreign investors have been selling.

Momentum stocks briefly dipped after the Finance Minister’s call for stricter market oversight, but quickly rebounded.

JCI Keeps Climbing in October

The JCI continued to gain strength in October, even reaching a new high of 8,257. It’s an exciting time for investors, though most of the gains continue to be driven by momentum stocks, not the whole market.

Momentum Stocks Power the Rally, But Why?

There’s no single reason why these fast-moving stocks keep climbing. Some are rising on company news. Others are rising because there’s been rumors that they will be included in the MSCI* (Morgan Stanley Capital International) Index during the next rebalancing on November 5th.

Stocks tend to go up when there is anticipation that they will be included in the MSCI Index. Being included in the index is like earning a “stamp of approval”, as companies can only be included if they meet certain criteria regarding:

Market size

Liquidity

Foreign ownership limits

Corporate governance

Being added to the MSCI Index signals quality and investability to global investors. Thus, when investors expect a stock to be added, demand often jumps, and prices usually follow.

*MSCI is a leading provider of investment tools, including stock market indices that are widely used as benchmarks for fund performance.

Local Investors Are Keeping the Market Alive

Even with all the action, it’s actually local investors who have been buying, not foreign ones. So far this month, foreign investors have sold around IDR 3.83T worth of Indonesian equities, while domestic investors continue to buy.

Regulatory Talk Sparks Brief Volatility

Last Thursday, Finance Minister Pak Purbaya urged the IDX and OJK to implement stricter regulations around market manipulation, especially in momentum stocks. He highlighted that maintaining integrity is key to encouraging younger generations to invest in Indonesia’s stock market. He also opened the opportunity to provide fiscal incentives if the market becomes cleaner and more transparent.

After his remarks, momentum stocks briefly dipped, while blue-chip names (especially banks) spiked. But the weakness didn’t last long. Most momentum names bounced right back before the market closed. It’s a sign that momentum plays are still driving much of the market’s energy.

What Simpan’s Investment Team Did

The JCI’s strong performance shows just how resilient local investors have been. But since much of the rally is being driven by short-term momentum, it’s a good idea to stay selective and focus on quality names with solid fundamentals.

Amid this rally, we’ve continued taking profits from momentum stocks that have surged, while using the cash from our gains to rotate into blue-chips.

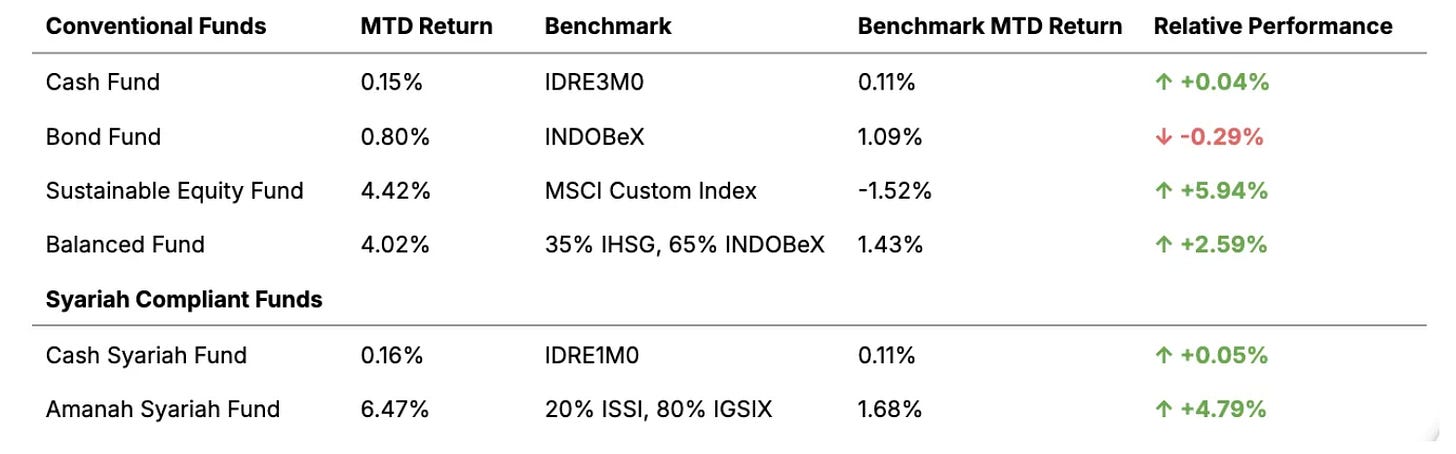

The JCI has gained +2.06% in October (data as of October 13th). In comparison, almost all of our funds have outperformed respective benchmarks MTD, as shown in the table below: