JCI at All-Time Highs, But Is the Rally Built to Last?

The JCI hit record highs, but we view the rally as narrow. Continue reading to see what our Investment Team is doing.

Momentum Stocks Steal the Spotlight

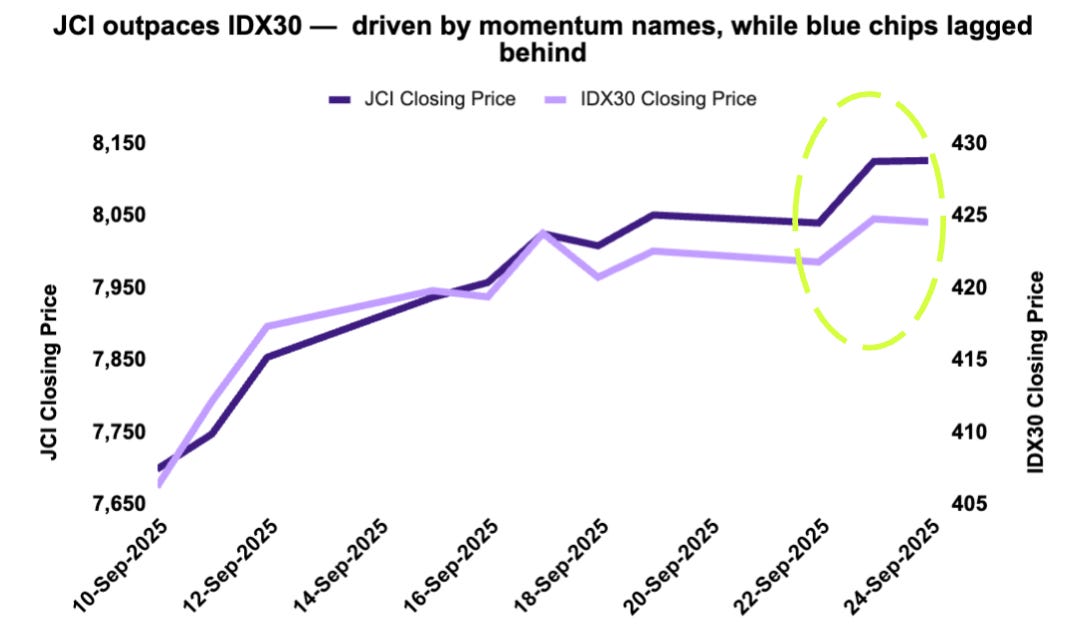

On Tuesday (23/9), the JCI hit a new all-time high of 8,125. Meanwhile, the IDX30—an index that tracks blue-chip stocks, stayed pretty quiet. When we take a closer look, the big push of the JCI came from momentum-driven names, especially in Commodities and Basic Materials. This means that the rally wasn’t broad-based.

As shown in the chart below, the widening gap between JCI and IDX30 highlights this trend. Because JCI captures both blue chips and momentum names, the lag in IDX30 makes it clear that momentum stocks were the real drivers of last week’s surge.

Domestic Players Led the Rally

A closer look shows that most of the action came from domestic players – retail investors, conglomerates, and a few local institutions. Foreign investors, on the other hand, reduced their exposure. Because participation is uneven, we think it’s hard to sustain the rally without broader support.

Rupiah Weakens, Bonds Find Support

The Rupiah weakened to USD 16,750 (as of September 25th) as foreign investors moved money out of Indonesia’s markets. Simply put: when investors take money abroad, the Rupiah tends to lose ground. The fact that they’re not putting their investments in Indonesia shows that there is a drop in confidence – another sign that the current rally might not last long.

In contrast, the bond market has shown resilience as local investors keep buying. Because the bond market is small, even modest demand can drive prices higher. Plus, with extra cash floating around from recent liquidity support from banks, some of it is ending up in bonds. That steady demand has kept yields down and shows that confidence in Indonesia’s economy is still strong.

Our Next Move: Took Profits, Rotating Into Blue-Chips

Here’s how our Investment Team responded to the rally:

Took profits from momentum stocks that had surged

Set aside cash from our gains to build a buffer in case of market corrections

Increasing exposure to blue-chip names across all sectors, with solid fundamentals and attractive valuations

Staying cautious in fixed income — sticking to bonds with good current yields for now, while staying ready to add longer maturities if markets correct

If you’re looking for exposure to quality names, check out our Sustainable Equity Fund. It’s positioned toward blue-chip stocks at attractive valuations, companies we believe are best placed to benefit in today’s market.

Thank you for keeping up-to-date with our investing and market insights. We are at your service. Should you need any assistance in opening an account, contact us here.