Fed’s Rate Cut: A Turning Point For Indonesia?

Fed cut rates by 25 bps last week. Discover what it means for Indonesia.

Key Takeaways:

Fed’s recent rate cut might be beneficial for Indonesian markets; possibility of foreign inflows and the strengthening of the Rupiah.

IHSG and bond market stayed quiet as markets already priced in the rate cut.

Fed Cut Rates by 25 bps. Why?

Last Wednesday, The U.S. Federal Reserve cut interest rates by 25 basis points, bringing the benchmark down to 3.75–4.00%, the lowest level in three years. The rationale behind the rate cut? A weakening labor market, often a sign that the economy is slowing. To support growth, the Fed decided to make borrowing cheaper — that’s what a rate cut does.

What’s The Impact To Indonesian Markets?

We view the recent rate cut as beneficial to Indonesian markets, although it might take some time for the effects to be realized. Here’s why:

1. Foreign investors might start to rotate into Indonesia’s capital markets.

The drop in U.S. interest rate means that returns on U.S. assets become less attractive.

That often pushes foreign investors to look for higher-yielding opportunities, often found in emerging markets like Indonesia.

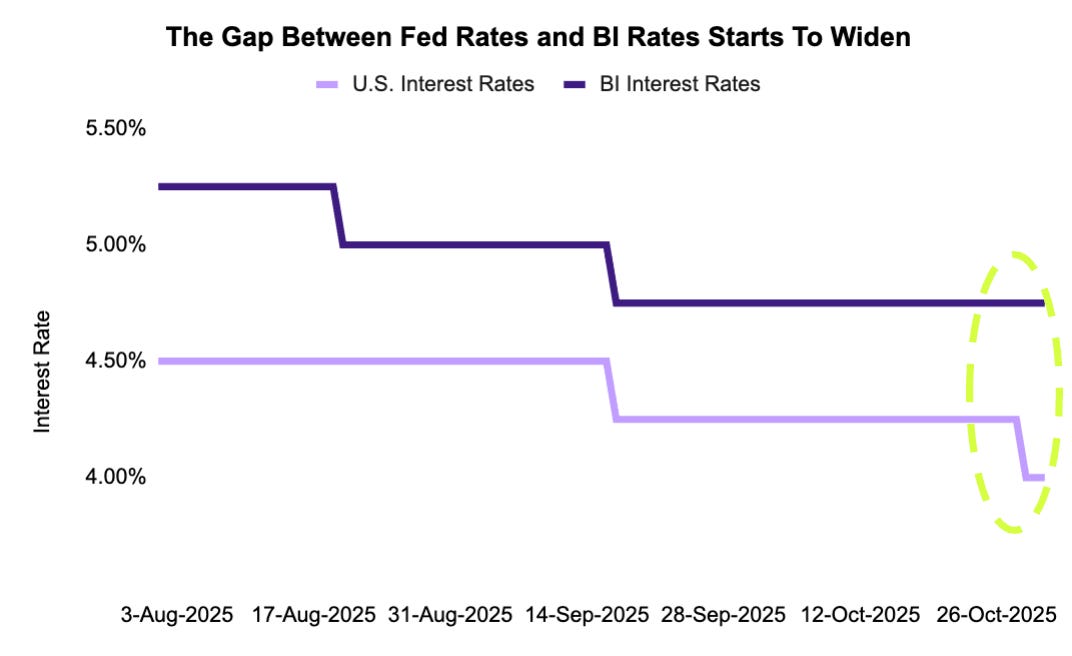

For months, the interest rate gap between the U.S. and Bank Indonesia (BI) was very narrow. With almost no extra reward, investors preferred holding U.S. assets, which are seen as safer. Now that the Fed has cut rates, that gap has widened, which could reopen foreign appetite for Indonesian markets.

2. Rupiah could strengthen.

When foreign investors enter Indonesia, they would need to shift their funds from U.S. dollars to Rupiah to purchase Indonesian investments. This pushes demand for the Rupiah and makes the currency stronger.

IHSG and Bond Market Remain Stable

You might expect the IHSG to rally after such news, but that didn’t happen. Both blue-chip and momentum stocks barely moved, and this was because markets have already priced in a Fed rate cut. We did not see meaningful flows into Indonesian markets.

The bond market showed a similar pattern. Normally, rate cuts push yields lower. This is because investors will rush to buy existing bonds with higher coupons as new bonds issued will have lower coupons. This time, we saw the opposite: U.S. and Indonesian bond yields increased slightly after the announcement. For now, bond trading remains quiet, led by domestic investors in short-term papers, while foreigners stay on the sidelines.

What We Did

For now, markets remain steady as investors stay cautious. At Simpan, we are doing the same:

We continue to reduce exposure to momentum stocks and are being more selective, only investing in high-conviction names.

We remain concentrated in blue-chip stocks: companies with strong fundamentals and attractive valuations.

In Fixed Income, we continue to adopt a barbell strategy, focusing on bonds with attractive yields.